|

|

27 January 2025 Forest through the trees |

| LMAX Digital performance |

|

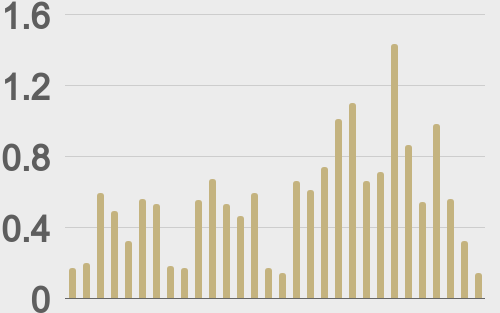

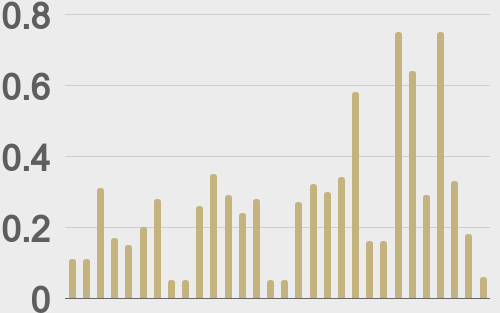

Total notional volume from last Monday through Friday came in at $4.4 billion, building on an impressive performance from a week earlier. Breaking it down per coin, bitcoin volume came in at $2.7 billion, 52% higher than the previous week. Ether volume came in at $462 million, 6% lower than the week earlier. Total notional volume over the past 30 days comes in at $16.6 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $10,066 and average position size for ether at $2,605. Market volatility remains elevated but has been cooling off after peaking out the other week. We’re looking at average daily ranges in bitcoin and ether of $4,360 and $190 respectively. |

| Latest industry news |

|

Crypto assets have come under intense pressure as the new week gets going. We believe the primary drivers for the weakness come from developments within the crypto space and from external pressures. As far as crypto specific developments go, the market is in a period of cool down after already absorbing all of the positives around the Trump administration’s warm embrace of crypto assets. Effectively, we’re seeing some selling of the fact after many weeks of build-up towards this bullish event. Meanwhile, we’re seeing a wave of downside pressure on US and global equities, with setbacks coming from renewed fears around Trump trade policies and a batch of unimpressive PMI data out of China. There has also been quite a bit of chatter around positioning into this week’s Fed decision. Investors are hoping the Fed will lean more to the accommodative side but are fearful the Fed won’t be as dovish as what the market would like to see. The most important takeaway right now is to see the forest through the trees. When we look at the bitcoin chart, there is nothing bearish about the price action. Technically speaking, bitcoin has just come off a fresh record high and is consolidating above $90k. At this point, it would take a deeper setback below $90k to warn of a more significant correction. Until then, dips are expected to be exceptionally well supported ahead of the next major upside extension to yet another record high. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@EuroDale |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||