|

|

1 April 2025 From Q1 blues to April gains |

| LMAX Digital performance |

|

LMAX Digital volumes got off to a healthy start this week. Total notional volume for Monday came in at $473 million, 9% above 30-day average volume. Bitcoin volume printed $254 million on Monday, 15% above 30-day average volume. Ether volume came in at $58 million, 31% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,609 and average position size for ether at $2,384. Bitcoin volatility has fallen back into the lower end of a familiar consolidation range. ETH volatility has been trending lower towards multi-week lows. We’re looking at average daily ranges in bitcoin and ether of $3,118 and $109 respectively. |

| Latest industry news |

|

April has reigned as bitcoin’s third-strongest month, a historical beacon of hope for investors. This tidbit shines especially bright after a bruising Q1, where bitcoin weathered a disheartening drop of over 10%. For those nursing portfolios back to health, April’s track record offers a soothing balm. Diving into the numbers from 2016 onward, April boasts an impressive average return of 11.42%. Should this pattern hold, it could ignite a powerful tailwind, propelling bitcoin back toward its broader uptrend and setting the stage for a dramatic retest of this year’s all-time high. The prospect alone is enough to stir excitement among the crypto faithful. Adding fuel to the fire, corporate heavyweights remain undeterred in their bitcoin accumulation. Just in the last few days, Strategy (the rebranded MicroStrategy) and Metaplanet have made headlines with fresh purchases, doubling down on their conviction. It’s a bold signal that institutional faith in bitcoin’s future is unwavering. The optimism doesn’t stop there. BlackRock’s CEO, Larry Fink, has taken to the podium, championing digital assets with fervor. He’s even floated a provocative warning: the U.S. dollar’s status as the world’s reserve currency could be on shaky ground, with bitcoin lurking as a potential usurper. It’s a narrative shift that’s impossible to ignore. Yet, storm clouds linger on the horizon. Traditional markets are gripped by unease, with recession fears and whispers of global trade wars rattling investor confidence. Tomorrow’s Liberation Day deadline looms large, promising new details that could either calm the waters or heap more pressure on risk assets. For now, the crypto community holds its breath, hoping the next chapter brings relief rather than turbulence. |

| LMAX Digital metrics | ||||

|

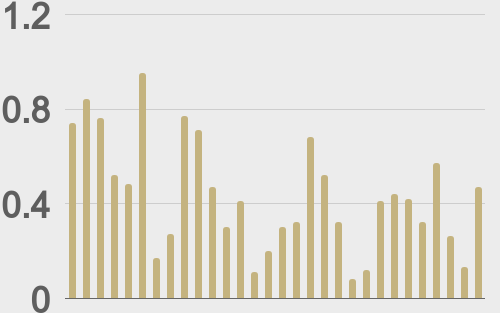

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

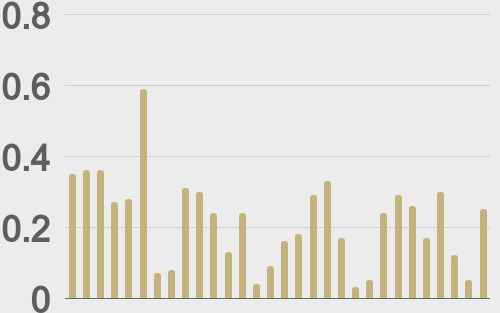

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

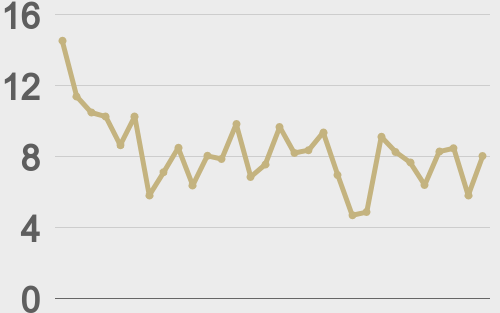

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@BitcoinMagazine |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||