|

|

22 April 2024 Getting ready for next bullish breakout |

| LMAX Digital performance |

|

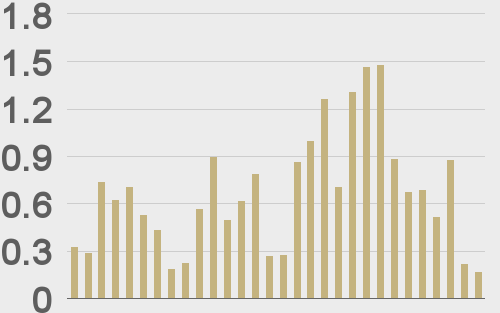

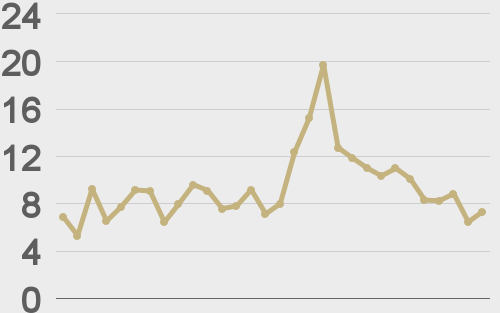

Total notional volume at LMAX Digital cooled off in the previous week. Total notional volume from last Monday through Friday came in at $3.7 billion, 29% lower than a week earlier. Breaking it down per coin, bitcoin volume came in at $2.3 billion in the previous week, 32% lower than the week earlier. Ether volume came in at $906 million, 24% lower than the week earlier. Total notional volume over the past 30 days comes in at $20.2 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,867 and average position size for ether at $4,688. Market volatility is tracking just off multi-month highs after peaking in March. We’re looking at average daily ranges in bitcoin and ether of $3,521 and $201 respectively. |

| Latest industry news |

|

It almost feels like the selling of the news on the bitcoin halving event already played out ahead of the actual event. We say this because there was so much anticipation in the lead up, that in the final countdown, market participants were already taking profit on the news. This theory sounds all the more compelling as we look at the bullish price action in recent sessions. Interestingly enough, all of this aligns with our technical view arguing the outlook remains highly constructive while above $59k. And so, as per this technical view, the recent weakness we had seen below $60 had done nothing to compromise the structure, with the market holding well above that $59k support barrier. Fundamentally speaking, there are two potential catalysts for the recent recovery. Both come from the global macro. The first is the fact that worry around fear of escalation of tension in the Middle East has eased. Though we have long argued bitcoin should be rallying during periods of risk off, the fact remains that for the time being, bitcoin is vulnerable to periods of intense risk off in financial markets. The second catalyst for the recovery could be coming from where we are at with US rates pricing. We have seen such an aggressive repricing of rate expectations, the balance of risk now seems to be tilted back in favor of currencies relative to the US Dollar, which also means yield differentials moving out of the Buck’s favor with respect to bitcoin. What we mean here is that the market has gone from pricing over 6 rate cuts from the Fed at the start of the year to pricing less than 2 rate cuts. This repricing has been bullish for the US Dollar. But now that we may have seen the extent of the repricing, it could open a move back out of the US Dollar’s favor, which in turn will serve to benefit bitcoin and other crypto assets. |

| LMAX Digital metrics | ||||

|

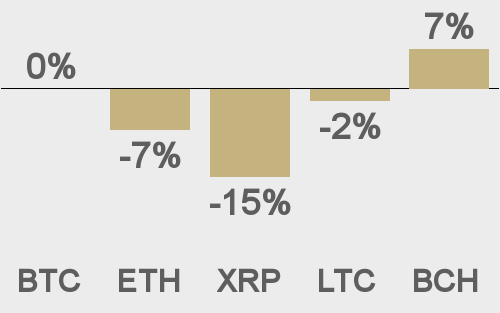

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

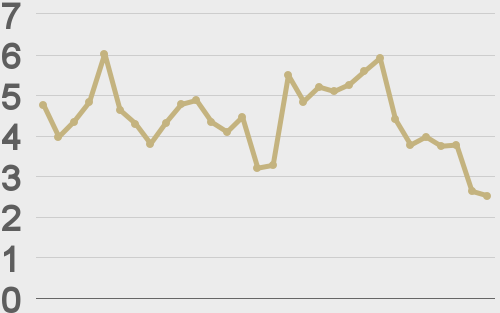

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@woonomic |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||