|

|

29 June 2023 Hard to ignore the broad based US Dollar inflows |

| LMAX Digital performance |

|

LMAX Digital volumes continue to cool on Wednesday. Total notional volume for Wednesday came in at $308 million, 15% below 30-day average volume. Bitcoin volume printed $177 million on Wednesday, 13% below 30-day average volume. Ether volume printed $88 million, 18% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $6,737 and average position size for ether at 2,690. Volatility has picked back up in the month of June after trading down at yearly low levels to start the month. We’re looking at average daily ranges in bitcoin and ether of $984 and $65 respectively. |

| Latest industry news |

|

Ongoing speculation that BlackRock’s application for a bitcoin ETF will be approved, has continue to invite support to the bitcoin market into dips. According to a senior ETF analyst at Bloomberg Intelligence, BlackRock has had 575 filings approved by the SEC, and only one rejection. Clearly this bodes well for this latest application, which if approved, will open the door for more bitcoin adoption. And we’ve already mentioned other big traditional finance names in the space, including Fidelity, also expected to file for approval of its own spot bitcoin ETF. So why have we been seeing bouts of weakness in the market in recent sessions? We think a lot of this has to do with bigger picture global macro flows. There has been a clear and intense wave of renewed demand for the US Dollar as we head into the latter portion of the week. This has been brought about by softer inflation data in countries outside of the US, along with concerning economic data and developments outside the US. Couple this with US economic data that has been more solid of late and a Fed policy outlook that continues to lean hawkish, and it’s no surprise to see the Dollar demand. And so, crypto by extension has fallen victim to this latest wave of broad based US Dollar inflow. But as per our technical insights in today’s report, we believe any setbacks in bitcoin should now be well supported into the $28k area. |

| LMAX Digital metrics | ||||

|

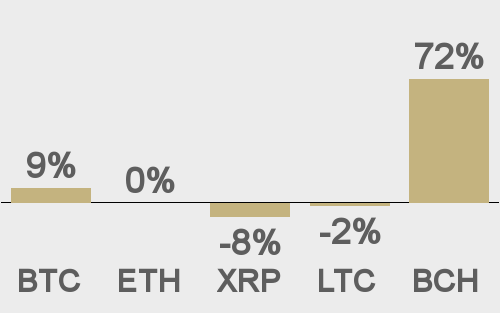

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

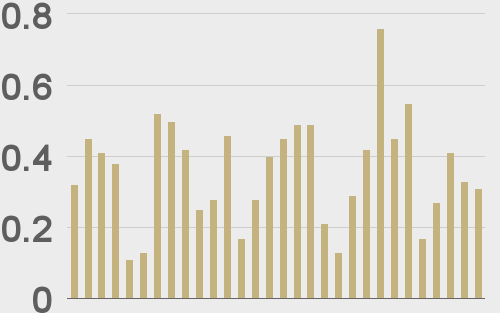

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

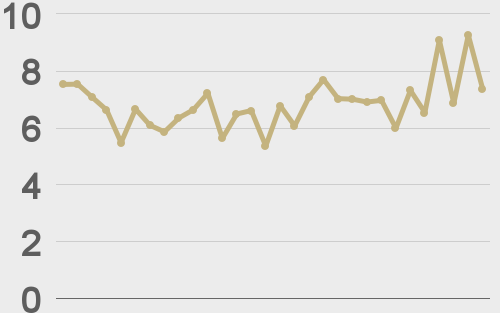

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

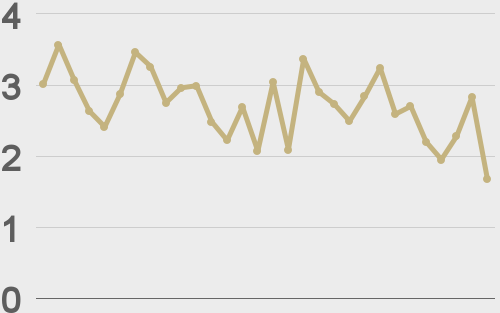

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||