|

| 28 May 2025 Hedge funds eye bigger crypto bets in 2025 |

| LMAX Digital performance |

|

LMAX Digital volumes picked up nicely from Monday’s thin holiday levels. Total notional volume for Tuesday came in at $547 million, 25% above 30-day average volume. Bitcoin volume printed $293 million, 43% above 30-day average volume. Ether volume came in at $122 million, 13% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,987 and average position size for ether at $2,796. Bitcoin volatility continues to be rather subdued, just off recent yearly low levels, while ETH volatility has picked up since bottoming out earlier this month. We’re looking at average daily ranges in bitcoin and ether of $2,870 and $143 respectively. |

| Latest industry news |

|

The crypto market remains resilient, with bitcoin holding just off recent record highs, supported by strong institutional interest and enthusiasm around the annual Bitcoin Conference. Meanwhile, SharpLink Gaming’s $425M private placement to adopt ETH as its primary treasury reserve asset has been a nice boost for ETH. This follows BlackRock, Fidelity, and VanEck ETH purchases and record ETH futures open interest. Bullish options activity reflects market optimism as well, with CoinDesk reporting the $300,000 bitcoin call option for June 27 expiry leading with over $600M in notional open interest, alongside strikes at $115,000, $125,000, and $150,000. Other encouraging developments include Trump Media’s plan to raise $2.5B for a major bitcoin treasury, and an industry report that 65% of surveyed hedge funds plan to increase crypto allocations in 2025. These corporate pivots highlight a trend of firms diversifying reserves with crypto, reinforcing market confidence despite short-term volatility. |

| LMAX Digital metrics | ||||

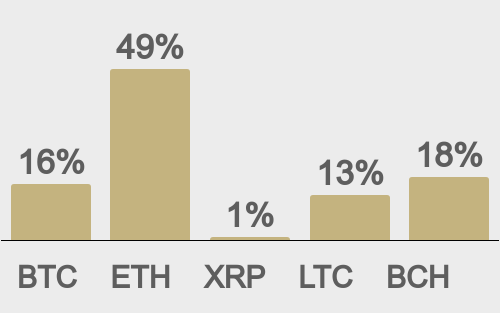

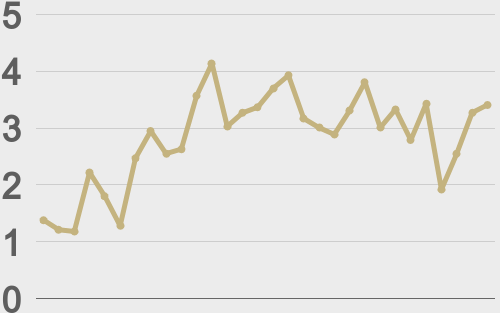

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

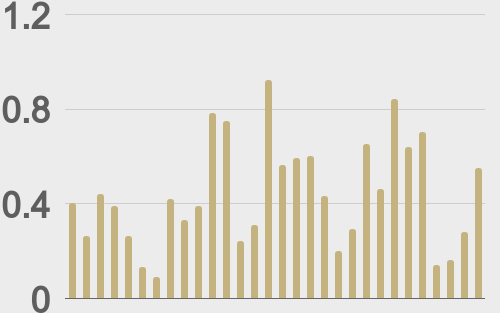

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

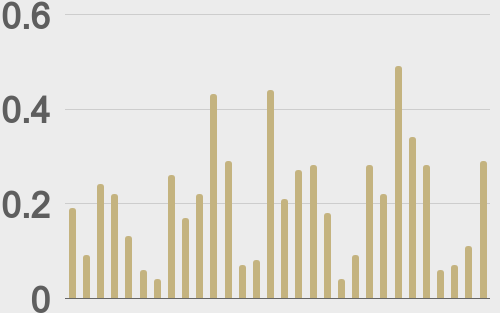

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

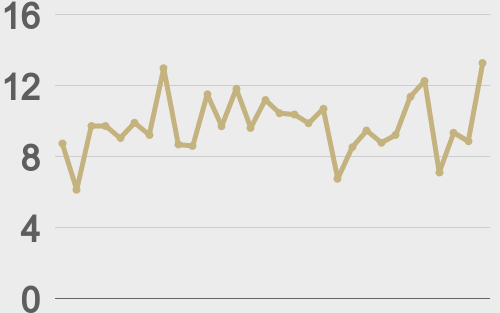

| Average daily range | ||||

|

||||

|

||||

|

@BitcoinMagazine |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||