|

|

28 February 2024 Highest daily volume since early January |

| LMAX Digital performance |

|

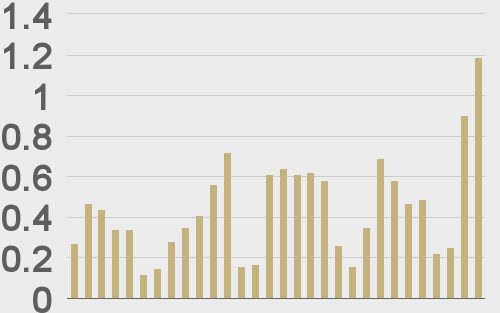

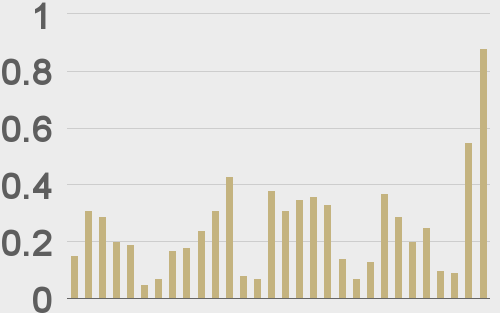

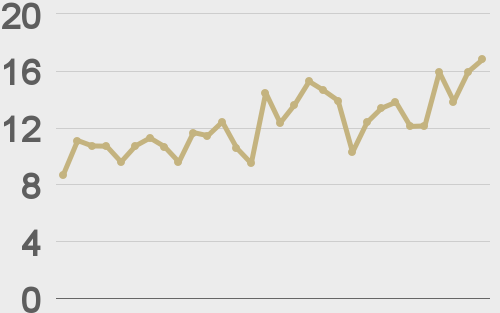

LMAX Digital volumes were strong on Tuesday, coming it at the highest levels since early January. Total notional volume for Tuesday came in at $1.2 billion, 167% above 30-day average volume. Bitcoin volume printed $884 million on Tuesday, 252% above 30-day average volume. Ether volume came in at $214 million, 52% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,774 and average position size for ether at $3,745. Volatility metrics have been healthy, tracking back towards peak levels from January, also accompanied by strong price appreciations. We’re looking at average daily ranges in bitcoin and ether of $1,657 and $109 respectively. |

| Latest industry news |

|

At the moment, the biggest knock against bitcoin and crypto assets is the the fact that this latest run has the daily charts in overbought territory and well overextended. This suggests that we could soon see a period of consolidation and correction to allow for these studies to unwind before considering the next major upside extension to retest and break bitcoin’s record high from 2021. Fundamentally, everything looks quite healthy. Bitcoin ETF demand has been trending up and setting fresh record highs (across the 9 new funds), eclipsing the initial record from opening day. The data also shows the 9 ETFs holding assets under management 7 times greater than the amount of new bitcoin mined since the launch of the ETFs on January 11. Meanwhile, open interest in the bitcoin futures market at the Chicago CME is also looking good, tracking back towards the record high levels seen when the ETFs were initially approved. Another bullish development that should not be understated is the performance in crypto assets relative to US equities. The fact that there has been a lower correlation is something that makes crypto all the more attractive as a portfolio diversification asset. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

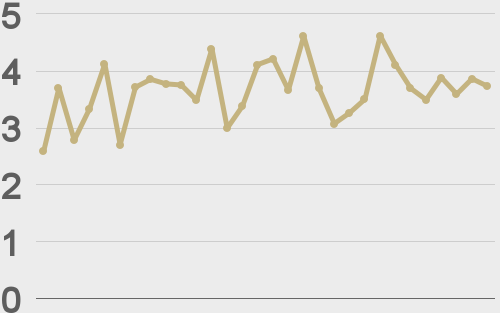

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||