|

| 15 October 2025 Holding cautious ground amid macro headwinds |

| LMAX Digital performance |

|

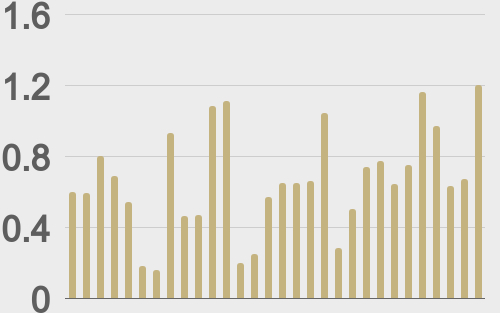

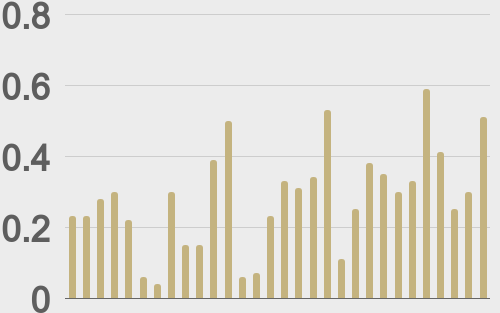

LMAX Digital volumes were impressive across the board on Tuesday. Total notional volume came in at $1.2 billion, 80% above 30-day average volume. Bitcoin volume printed $512 million, 80% above 30-day average volume. Ether volume came in at $364 million, 64% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,931 and average position size for ether at $3,444. Bitcoin volatility has shot up in recent days, while ETH volatility is trending back towards recent peak levels. We’re looking at average daily ranges in bitcoin and ether of $3,875 and $253 respectively. |

| Latest industry news |

|

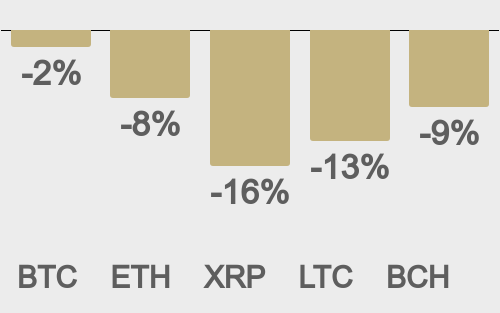

Over the past 24 hours, the crypto market has seen modest downward pressure, with bitcoin slipping slightly and ETH underperforming. The broader tone is cautious rather than panicked, as investors gauge exposures and digest macro headlines. Volatility remains elevated, and short-term flows seem dominated by reactions to risk-on/risk-off shifts rather than fresh, conviction-driven buys. Liquidity in derivatives remains a key undercurrent: forced liquidations or cascades in leveraged derivatives could trigger outsized moves in thin periods. Ether has followed bitcoin lower, though the recent outperformance narrative — supported by institutional interest in its DeFi and smart contract utility — is being challenged by macro headwinds. One major driver here is geopolitical friction, particularly renewed escalation in U.S.–China trade tensions, which is unsettling risk assets broadly. The market is also watching inflation data and central bank signaling closely — in the traditional markets, equities and credit are vulnerable to a sudden reassessment of rate expectations. The International Monetary Fund’s warning about overvalued assets and interconnected financial risks is stoking cautious positioning across asset classes. Meanwhile, crypto-specific themes matter too. ETF flows into digital-asset vehicles, changing regulatory signals, and on-chain behavior by whales or institutional holders are non-trivial levers of sentiment. If macro risks intensify, crypto could suffer as a beta play on global risk, but if clarity emerges from monetary or trade policy, it will look to reestablish upward traction. Given seasonality trends showing exceptionally strong October and Q4 performance, our outlook leans to the latter. |

| LMAX Digital metrics | ||||

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

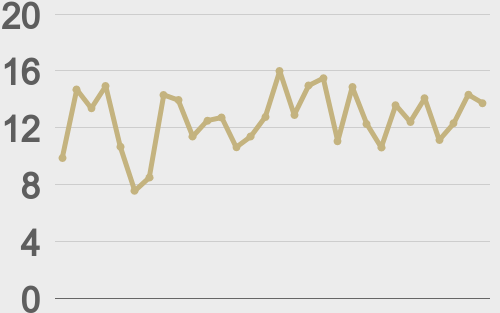

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||