|

|

3 May 2022 Hoping for a better month |

| LMAX Digital performance |

|

LMAX Digital volume got off to a nice start this week. Total notional volume for Monday came in at $681 million, 34% above 30-day average volume. Bitcoin volume printed $462 million on Monday, 61% above 30-day average volume. Ether volume came in at $180 million, 13% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,316 and average position size for ether at 7,014. Volatility has been trending lower in 2022. We’re now looking at average daily ranges in bitcoin and ether of $1,553 and $135 respectively. |

| Latest industry news |

|

Seasonality trends were not helpful as an indicator for performance in the month of April. Heading into the month, there was an expectation we would see outperformance in crypto assets, with April being the strongest month of performance over the past several years. But in the end, it was anything but, with bitcoin and ether under pressure for the entire month and closing at the lows of the month, both down some 17%. Of course, the price action was consistent with price action in traditional markets, with a massive bout of risk liquidation weighing on crypto, clearly reflecting the strong correlation. And while we believe this correlation between risk off and crypto off will fade sooner than later, for the time being, it is alive and well. Worry around rising inflation and slower growth around the globe has put pressure on risk correlated assets. And to many out there, cryptocurrencies are considered to be risk correlated assets given the fact that they are still young and maturing. Nevertheless, we are getting down to levels where we believe medium and longer-term players will be happy to step in to take advantage of crypto’s exceptional value proposition. In our view, we could see fallout from downside pressure in US equities that takes bitcoin and ether back down into the $30k and $2k areas respectively. But we don’t see these markets moving much lower than that. The amount of bitcoin changing hands over the past year has been exceptionally low, a statistic that shows investors having plenty of conviction. Meanwhile, we continue to see positive updates from the regulatory front. The Central African Republic was the second country to officially adopt bitcoin as legal tender, while Panama has just passed legislation to bring crypto into its regulatory framework. This news also follows another important update in April, which was the news that Fidelity would soon offer bitcoin as investment option in 401(k) plans. |

| LMAX Digital metrics | ||||

|

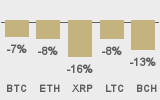

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||