|

|

14 November 2023 How much upside has been priced in? |

| LMAX Digital performance |

|

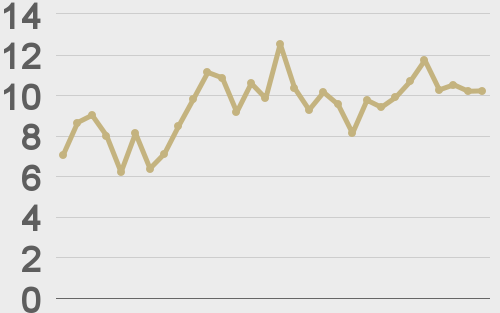

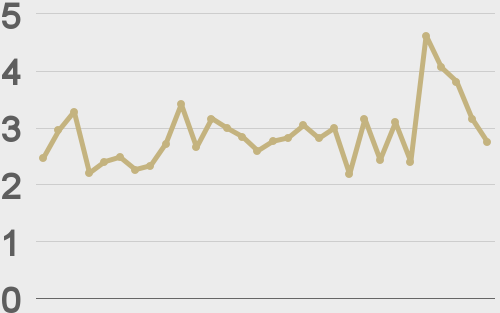

LMAX Digital volumes were up a healthy amount to start the week. Total notional volume for Monday came in at $475 million, 26% above 30-day average volume. Bitcoin volume printed $252 million on Monday, 4% above 30-day average volume. Ether volume came in at $152 million, 66% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,639 and average position size for ether at $3,054. Volatility has been on the upswing since bottoming out at multi-month lows in August of this year. In recent sessions, bitcoin volatility has deferred to some consolidation, while ether volatility has continued to climb. We’re looking at average daily ranges in bitcoin and ether of $1,050 and $67 respectively. |

| Latest industry news |

|

The crypto market is waiting on pins and needles to see whether or not the SEC will go ahead and approve bitcoin spot ETFs. There has been a decent amount of speculation such an approval could come as soon as the days ahead. However, overall, the broad consensus is that an approval will come between now and Q1 2024. Many market participants have speculated most of the upside has now been priced in around this event, though we remain skeptical this is in fact the case. The SEC has been so difficult working with crypto that we believe there is still plenty of money that has yet to make those bets on an approval actually going through. Moreover, there is other evidence to suggest the approval will only result in a consistent flow of upside pressure on the bitcoin price. One asset manager cites the approval of a gold spot ETF in 2004 which contributed to a multi-year runup in the price of gold. Moving on, we haven’t spent much time talking about seasonality trends in November. The main reason for this is because there really hasn’t been much of a reliable historical trend in November. The past two Novembers were down months, and the November before that was exceptionally strong. Looking back even further, it’s been a story of some months down and some months up. As far as today goes, there will be a lot of talk about the anticipated release of US inflation data. But as we’ve already highlighted in recent updates, there is a good case to be made for bitcoin to rally whatever the outcome. If the data comes in below forecast, it will fuel broad based selling in the US Dollar, which will invite a path for bitcoin demand. If on the other hand the data comes in hot, it will open the door to a wave of risk off flow, which could just as easily make bitcoin attractive given its store of value properties. So ultimately, while the US inflation data could have a major impact on traditional financial markets, we don’t believe there should be much risk associated with the release as far as bitcoin goes. |

| LMAX Digital metrics | ||||

|

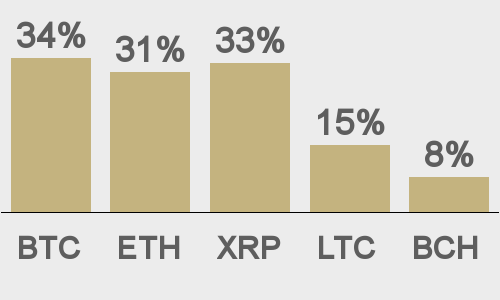

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

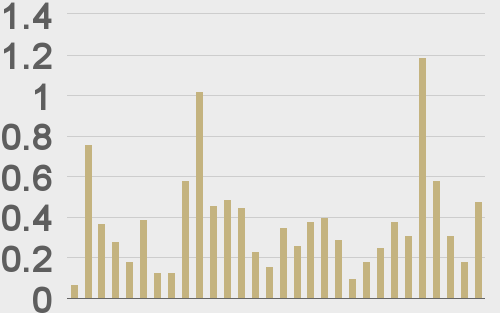

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||