|

|

1 April 2024 Inflows and deal flow looking up |

| LMAX Digital performance |

|

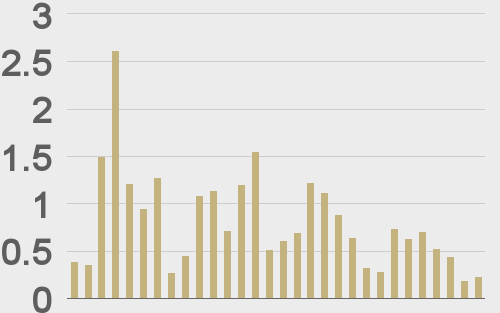

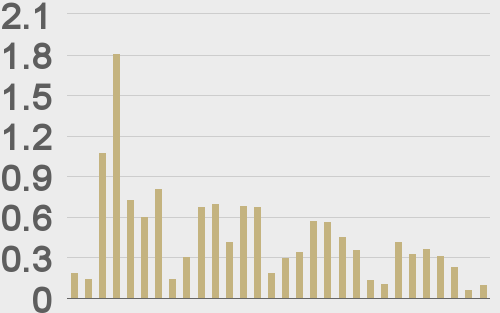

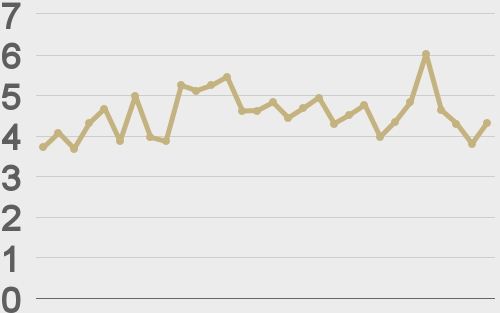

Total notional volume at LMAX Digital cooled off in the previous week, with a lot of the lighter trade attributed to the Easter holiday. Total notional volume from last Monday through Friday came in at $3.1 billion, 33% lower than a week earlier. Breaking it down per coin, bitcoin volume came in at $1.7 billion in the previous week, 27% lower than the week earlier. Ether volume came in at $813 million, 51% lower than the week earlier. Total notional volume over the past 30 days comes in at $24.6 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $10,050 and average position size for ether at $4,581. Market volatility has been in cool down mode since peaking in Mid-March. We’re looking at average daily ranges in bitcoin and ether of $3,152 and $190 respectively. |

| Latest industry news |

|

Any concerns around a wave of outflows from the bitcoin spot ETFs the other week were quickly offset after last week’s strong performance. Bitcoin ETF flows produced $859 million of inflows in the previous week, which came close to matching outflows from a week earlier of $888 million. Deal flow has also been encouraging in the space. We’re coming out of a March month of deal flow in the crypto space that tracked at the highest level in a year. In March, we saw about $1 billion in deal flow. This was made up of more than 140 deals, which was the highest number of deals in a month since 2022. Deal flow was led by infrastructure and gaming transactions. As far as price action goes, we haven’t seen much change at all. Bitcoin has been confined to a tight consolidation just off the March record high. As per our technical insights, we’re waiting for bitcoin to put in that next higher low ahead of a bullish continuation through the recent record high and towards the next major objective at $100k. Of course, we’re finally into the long awaited month of April, which features the bitcoin halving event. We’ve said that we could see some positive price action due to the fact that the halving event will be getting a bigger audience this time round on account of the wider adoption. At the same time, we don’t expect there to be too much action when considering the event has been well telegraphed and therefore presumably mostly priced in. Our biggest concern in April is around developments in the traditional markets. We continue to worry about an overcooked US equity market that could be on the verge of rolling over. While we believe any crypto fallout from such an event will be short-lived, this doesn’t change the fact that a reversal of stocks could be disruptive to crypto assets in the short-term. Finally, a dark chapter in the crypto market’s history is coming to a close after former FTX CEO Sam Bankman-Fried was sentenced to 25 years in prison. SBF was convicted on all seven counts of defrauding customers, lenders and investors. The judge didn’t take kindly to the fact that SBF had perjured himself during the November trial, and wasn’t impressed with the defense’s claims that there were no losses from SBF’s actions. |

| LMAX Digital metrics | ||||

|

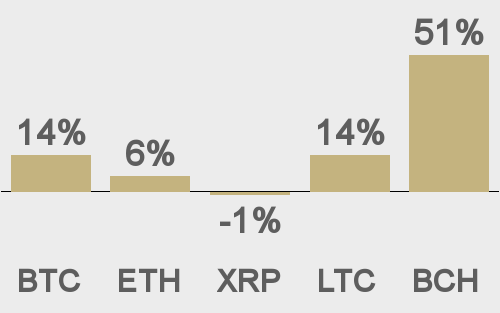

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||