|

|

29 August 2024 Insights into the ETHBTC ratio |

| LMAX Digital performance |

|

LMAX Digital volumes traded up to the highest level on the week on Wednesday, also well above 30-day average volume. Total notional volume for Wednesday came in at $518 million, 31% above 30-day average volume. Bitcoin volume printed $289 million on Wednesday, 20% above 30-day average volume. Ether volume came in at $157 million, 62% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,343 and average position size for ether at $2,823. Market volatility has cooled off after an impressive run higher in early August. We’re looking at average daily ranges in bitcoin and ether of $2,647 and $140 respectively. |

| Latest industry news |

|

Setbacks in crypto assets are once again proving to be exceptionally well supported on dips. It feels like a lot of the weakness seen this week is more a function of thin summer trade and leveraged long liquidations than anything fundamentally significant. We do think it will be interesting to keep an eye on correlations between crypto assets and US equities. In recent days, strength in US equities has not been accompanied by upside follow through in crypto assets. This reflects a lower correlation, which could prove to be encouraging for crypto assets if stocks come under pressure. The point here is the prospect of a breakdown in correlation, leaving room for crypto to move higher even in the event of downside in stocks, as was seen on Wednesday. Another interesting development to keep an eye on is ETH performance. A nine day ETH ETF outflow streak has finally come to an end and the move back into the ETH ETFs could be signaling the start to a turnaround. ETH has been a notable underperformer relative to bitcoin since late 2022. But with ETHBTC finally trading down into some important longer-term support, the stage could be set for a reversal of the trend and the start to ETH outperformance. Wednesday’s impressive bullish ETHBTC reversal could very well be the catalyst to get this trend reversal going. Broadly speaking, when bitcoin and ETH are moving higher and ETH is outperforming, it sends a strong message there is plenty of appetite for investment in the crypto space as a whole. |

| LMAX Digital metrics | ||||

|

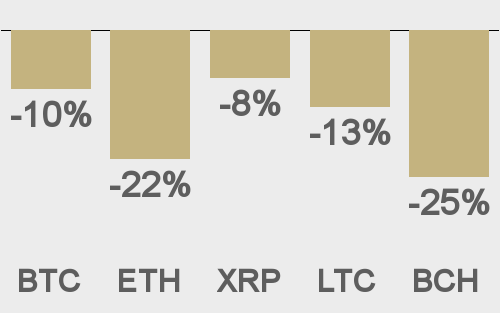

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

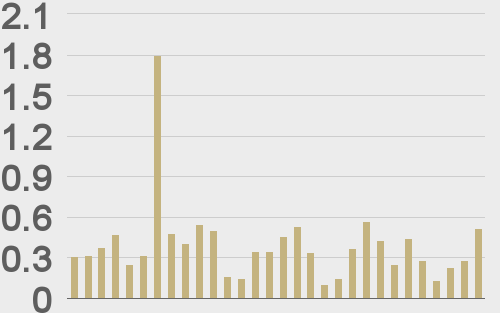

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||