|

| 19 August 2025 Institutional conviction healthy despite pullback |

| LMAX Digital performance |

|

LMAX Digital volumes got off to a healthy start this week. Total notional volume for Monday came in at $775 million, 32% above 30-day average volume. Bitcoin volume printed $342 million, 41% above 30-day average volume. Ether volume came in at $198 million, 49% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,521 and average position size for ether at $3,531. Bitcoin volatility continues to track just off yearly low levels. ETH volatility has been trending up since bottoming in May, at its highest levels since February. We’re looking at average daily ranges in bitcoin and ether of $2,814 and $215 respectively. |

| Latest industry news |

|

Bitcoin remains in minor correction mode since posting its latest record high in the previous week. Sentiment has been mostly steered lower by hotter-than-expected US inflation data, which dampened expectations for near-term rate cuts from the Fed. We would also attribute some of the selling to profit taking from shorter-term accounts and perhaps the recent statement from U.S. Treasury Secretary Scott Bessent that the Strategic Bitcoin Reserve would not be expanded with new purchases. Ethereum has mirrored Bitcoin’s retreat, as traders book profits following recent strong gains. Still, broader institutional interest remains resilient—evidenced by robust ETF flows and growing treasury allocations to ETH—which keeps the medium-term outlook constructive. Institutional appetite in the crypto space continues to grow. Re7 Capital, a crypto hedge fund, is targeting $100 million for its new multi-strategy Master Fund, while firms like Syz Capital are reigniting large-scale crypto allocations. This underscores that institutional conviction remains solid, even amid short-term market softness. Outside of crypto, markets are fixated on the upcoming Fed Chair address at the Jackson Hole Symposium, with monetary policy signals set to steer asset flows across equities, FX, and digital assets. The fact that the US government is anchoring strategic relevance to digital currencies, also adds additional policy weight in favor of crypto assets. Looking ahead, crypto markets sit at a delicate juncture: bolstered by institutional adoption and policy developments, but sensitive to macroeconomic data and central bank direction. Bitcoin continues to anchor the sector’s narrative, while Ethereum’s more volatile moves reflect investor sentiment dynamics amplified by on-chain leverage and ETF inflows. |

| LMAX Digital metrics | ||||

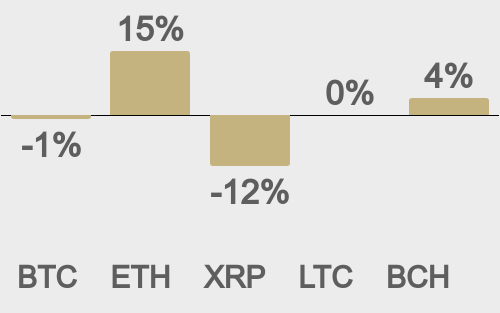

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

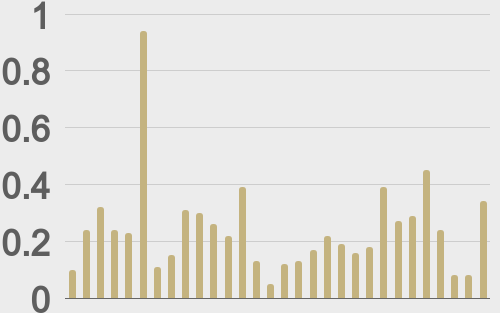

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

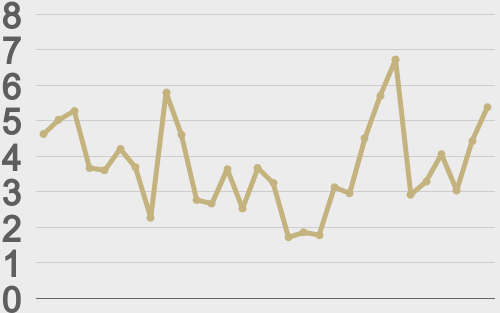

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||