|

|

21 April 2025 Institutional flows, corporate moves fuel optimism |

| LMAX Digital performance |

|

Total notional volume from last Monday through Friday came in at $1.6 billion, 59% lower than the week earlier, mostly on account of holiday thin trade. Breaking it down per coin, bitcoin volume came in at $757 million, 60% lower than the previous week. Ether volume came in at $332 million, 46% lower than the week earlier. Total notional volume over the past 30 days comes in at $12.5 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,979 and average position size for ether at $2,097. Volatility has calmed down in recent days, tracking at the lower bound of some multi-day ranges. We’re looking at average daily ranges in bitcoin and ether of $3,134 and $105 respectively. |

| Latest industry news |

|

Bitcoin continues to hold up well, showing resilience amidst a period of downside pressure on crypto assets. The bitcoin Fear & Greed Index is currently reflecting cautious optimism driven by institutional inflows and regulatory developments. Over the past few days, bitcoin’s price has been propelled by significant institutional activity, notably large inflows into U.S. spot bitcoin ETFs, which have tightened supply as whales reduce exchange reserves. Corporate adoption continues to bolster sentiment as well, with companies like MicroStrategy and Metaplanet adding to their holdings. Meanwhile, Visa will be joining a stablecoin consortium, reinforcing crypto’s integration into traditional finance. These moves underscore growing confidence in bitcoin as a strategic asset. Macro developments, particularly U.S.-China trade tensions and tariff uncertainties, have weighed on global markets, indirectly supporting bitcoin as a hedge against USD volatility and potential stagflation risks. The Trump administration’s push to influence Federal Reserve independence, including calls to replace Fed Chair Powell, has sparked market unease and broad based US Dollar outflows, contributing to bitcoin’s appeal as a decentralized asset. Additionally, a 90-day pause on non-China tariffs has provided temporary relief, stabilizing crypto markets alongside traditional assets. |

| LMAX Digital metrics | ||||

|

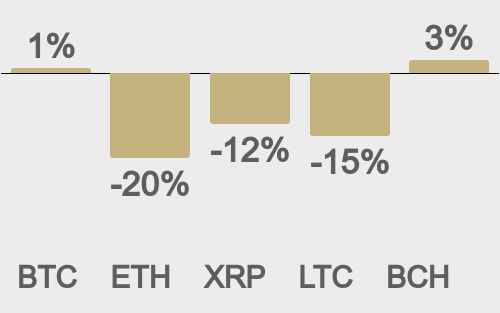

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||