|

| 26 August 2025 Institutional flows cushion crypto |

| LMAX Digital performance |

|

LMAX Digital volumes got off to a healthy start this week. Total notional volume for Monday came in at $681 million, 21% above 30-day average volume. Bitcoin volume printed $332 million, 42% above 30-day average volume. Ether volume came in at $213 million, 3% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,674 and average position size for ether at $3,368. Bitcoin volatility has been edging higher but continues to consolidate off yearly low levels. Meanwhile, ETH volatility has surged to its highest level since December 2021. We’re looking at average daily ranges in bitcoin and ether of $3,174 and $257 respectively. |

| Latest industry news |

|

Bitcoin has dipped below $110k as markets grapple with slightly less dovish signals from Fed Chair Powell. Though the Fed Chair maintained hints of rate cuts, his tone wasn’t as soft as investors wanted, rekindling demand for the U.S. dollar and weighing on risk assets. Ethereum has followed suit with a similar pullback. Still, demand remains exceptionally strong. Since early June, institutional treasury firms have accumulated ~2.6% of all ETH in circulation, and with ETF inflows added, total purchases now account for nearly 4.9% of supply. This structural buying pressure is expected to persist and continues to support ETH’s price beyond day-to-day fluctuations. Institutional interest in crypto remains robust. Re7 Capital is raising a $100 million multi-strategy fund, signaling continued confidence—even amid short-term softness. Projects like BitMine and SharpLink Gaming are aggressively expanding their ETH holdings, backing strategies with multi-billion-dollar allocations and setting the stage for sustained demand. Global markets continue to seek clarity on interest rate trajectories. Earlier hawkish nuance from Powell has sparked macro caution—but the longer-term outlook remains constructive. Supportive policy themes, institutional adoption, and growing corporate digital-asset holdings are creating a resilient structural foundation for crypto assets. In short, while prices have retreated, they’re doing so into strong underlying tailwinds—especially for ETH, where strategic accumulation and record ETF inflows reinforce its position as a rapidly maturing institutional asset. |

| LMAX Digital metrics | ||||

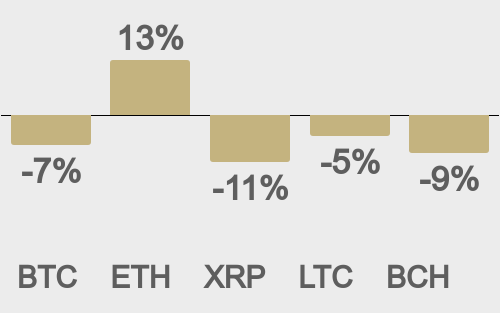

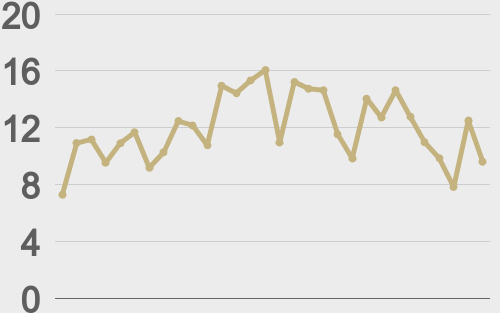

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

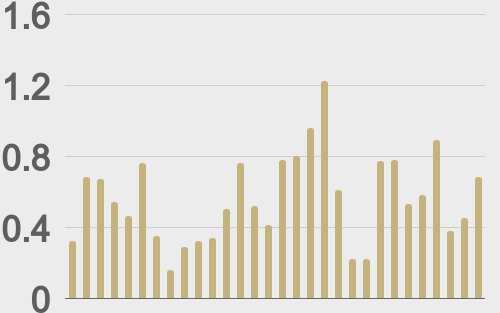

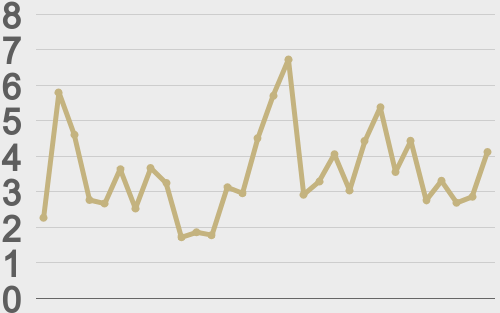

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

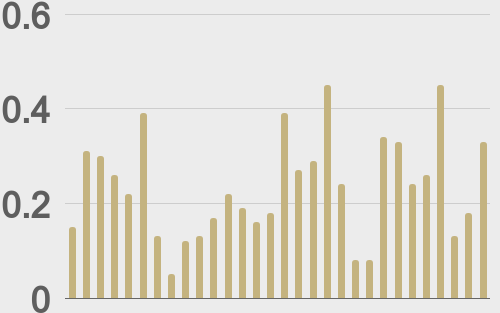

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@CoinDesk |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||