|

| 25 August 2025 Institutional flows should cushion macro jitters |

| LMAX Digital performance |

|

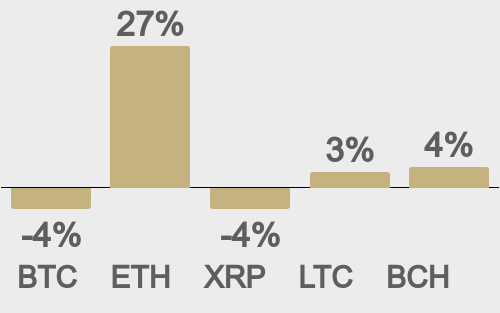

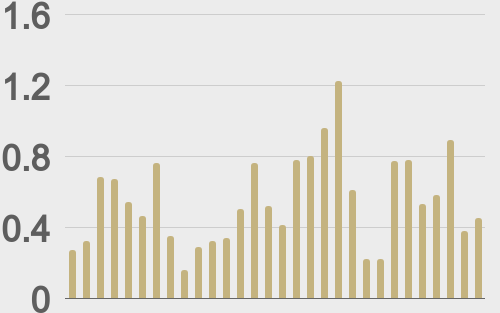

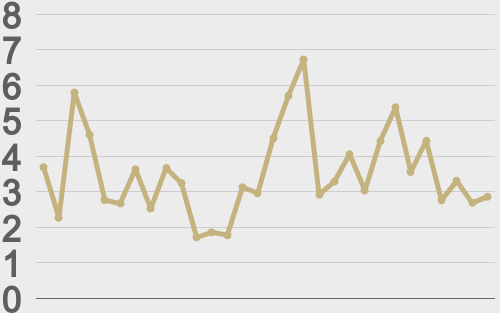

Total notional volume from last Monday through Friday came in at $3.5 billion, 19% lower than the week earlier. Breaking it down per coin, bitcoin volume came in at $1.6 billion, 1.2% lower than the previous week. Ether volume came in at $1.3 billion, 34% lower than the week earlier. Total notional volume over the past 30 days comes in at $16.5 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,726 and average position size for ether at $3,351. Bitcoin volatility continues to consolidate off yearly low levels. ETH volatility has surged to its highest level since December 2021. We’re looking at average daily ranges in bitcoin and ether of $3,157 and $252 respectively. |

| Latest industry news |

|

Bitcoin is under pressure to start the week. The decline reflects renewed demand for the U.S. dollar, softer equity futures, and possibly profit-taking after weekend volatility. A large bitcoin whale’s offloading was also in the news, reportedly sparking a Sunday flash crash. Ethereum has followed a similar trajectory after finally squeaking out a fresh record high, as investors lock in recent gains. Nevertheless, despite the short-term pullback, institutional conviction remains strong, with ETF inflows and corporate treasury allocations continuing to support long-term appeal. Markets remain laser-focused on the Fed’s next moves, with Powell’s words at Jackson Hole still driving sentiment swings. While he hinted at rate cuts, the nuance and less dovish undertone left markets jittery. In short, the crypto market is grappling with macro pressures—shifting Fed signals, dollar strength, and risk reduction—while structural tailwinds from institutional engagement and adoption continue to hold. As per our technical insights, the outlook remains highly constructive. As long as bitcoin holds above $110k on a weekly close basis, we expect the market to hold up well into dips. |

| LMAX Digital metrics | ||||

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@CoinDesk |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||