|

|

24 November 2022 Into a wait and see phase |

| LMAX Digital performance |

|

LMAX Digital volumes have been soft all week with the lighter holiday trade factoring into the thinner activity. Total notional volume for Wednesday came in at $306 million, 36% below 30-day average volume. Bitcoin volume printed $169 million on Wednesday, 37% below 30-day average volume. Ether came in at $58 million, 63% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $5,557 and average position size for ether at 2,785. Volatility is finally shooting up off yearly and multi-month lows. We’re looking at average daily ranges in bitcoin and ether of $771 and $84 respectively. |

| Latest industry news |

|

We’re still very much in a wait and see as far as fallout from the FTX implosion goes. But as things stand, we’ve at least managed to see some stabilization within the crypto space as both bitcoin and ether recover out from the recent lows. While we’re waiting to see how things play out in crypto land, attention has shifted back to global macro drivers, with this week’s dovish Fed speak and more dovish leaning Fed Minutes helping to inspire risk on flow. This has helped to prop up crypto assets. But of course, how things play out with Digital Currency Group (DCG) will likely have a major impact over the shorter-term, especially if the situation deteriorates to the point of insolvency and the need to liquidate assets. As of yet, we are still waiting for more clarity here. DCG’s Silbert has been out trying to reassure investors that the firm is in good position to weather the storm and come out stronger on the other side. Another sour note for the space right now is the news around crypto miner Core Scientific, who have come out warning investors of concerns that it might not be able to continue operations over the next 12 months without additional liquidity. Clearly miners have suffered in 2022 on account of the falling price of bitcoin and increasing energy costs. Technically speaking, the picture continues to lean bearish despite the latest minor recovery. As per our analysis over the past couple of days, the bitcoin market would need to take out $17,170 resistance at a minimum to even take the immediate pressure off the downside. Until then, risk remains for additional setbacks to fresh yearly lows and down towards the next major objective at $10,000. This would likely open enough pressure on the price of ether to take it back down to a retest and break of its yearly low from June at $880. |

| LMAX Digital metrics | ||||

|

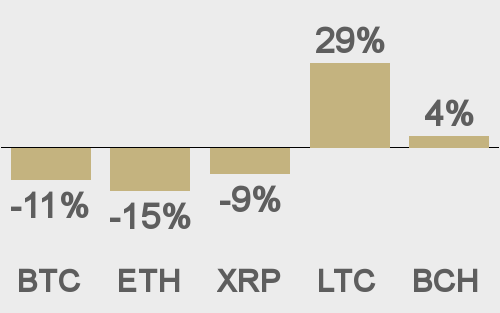

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

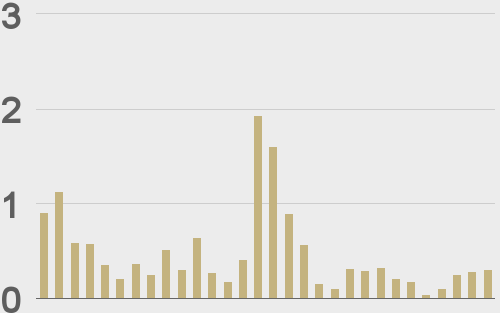

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

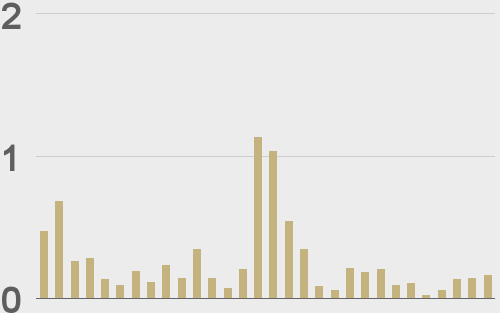

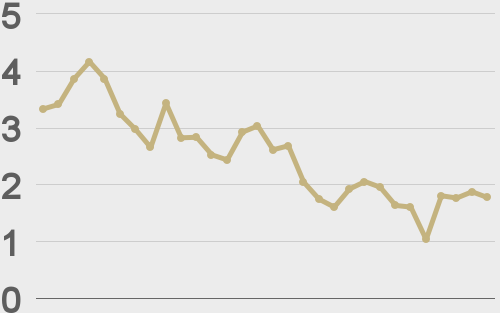

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||