|

|

21 November 2024 Is ETH getting ready to catch up? |

| LMAX Digital performance |

|

LMAX Digital volumes put in a solid performance on Wednesday. Total notional volume for Wednesday came in at $763 million, 27% above 30-day average volume. Bitcoin volume printed $547 million on Wednesday, 40% above 30-day average volume. Ether volume came in at $78 million, 19% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $10,518 and average position size for ether at $3,148. Market volatility has turned up aggressively in recent days. Bitcoin volatility is trading back towards yearly high levels, while ETH volatility is back into the 2024 mid-range. We’re looking at average daily ranges in bitcoin and ether of $3,332 and $152 respectively. |

| Latest industry news |

|

Bitcoin has continued with the charge to fresh record highs, seemingly on a mission to take out the much talked about psychological barrier at $100,000. As of the time of this update into the European open on Thursday, bitcoin is up 64% in Q4. The reason we bring this up is not to say the market is overextended, rather to highlight the possibility we still have more to run in 2024. If we look at Q4 performance for bitcoin since 2013, average returns have exceeded 80%. This leaves bitcoin with another 16% to match those average returns, which suggests we could see an overshoot of $100,000 and through $110,000 before the year is out. It will be interesting to see if all of this positive momentum finally has a more substantial impact on the price of the second largest crypto asset. ETH has been lagging all year relative to bitcoin and the ETHBTC ratio has been hit hard, trading to its lowest level since March 2021. This pairing is quite overextended on a technical basis and the prospect for some form of a bounce should be considered. Fundamentally, we’ve been highlighting the possibility that a warmer regulatory climate in the US will invite renewed flows into assets away from bitcoin, which would be a good catalyst to spark renewed demand for ETH. We got more signs of this the other day when it hit the wires that Donald Trump was considering a White House role exclusively dedicated to cryptocurrency policy. |

| LMAX Digital metrics | ||||

|

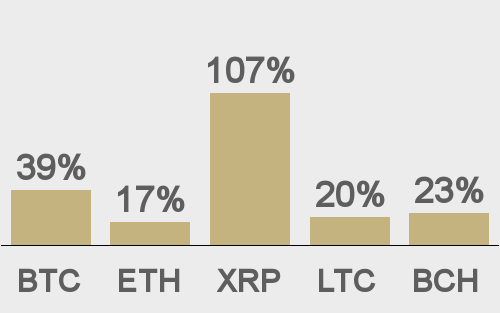

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

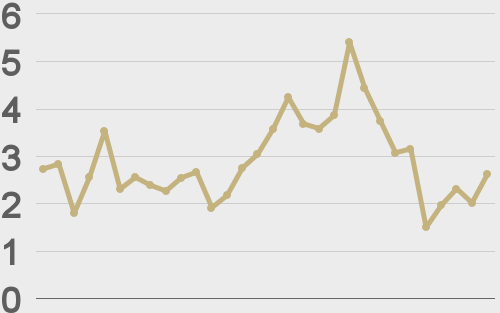

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||