|

|

26 January 2022 It’s all about the Fed decision |

| LMAX Digital performance |

|

LMAX Digital volume has been impressive this week. After a very strong Monday, we’ve seen healthy trading activity extended through Tuesday. Total notional volume for Tuesday came in at $902 million, 26 above 30-day average volume. Bitcoin volume printed $410 million on Tuesday, 10% above 30-day average volume. Ether volume came in at $408 million, 69% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,446 and average position size for ether at 5,253. Volatility has been trending lower into 2022. We’re now looking at average daily ranges in bitcoin and ether of $2,374 and $227 respectively. |

| Latest industry news |

|

All of the focus for today will be on the Fed decision. As things stand, crypto assets are still showing correlation with risk off. We don’t think this will last much longer given the lure of crypto as an alternative asset class, but for now, we still see this correlation holding up. The key point of focus will be on the Fed’s tone. No change is expected to rates, but it will all be about how the Fed communicates its message with respect to the path forward. As far as crypto markets go, if the Fed comes out delivering an as expected or less hawkish than expected message, it will likely fuel immediate demand for crypto, with prices seen recovering in a healthy way. If on the other hand we see a Fed that the market feels is leaning towards a more hawkish communication, we can expect another round of risk off on the less investor friendly message, with new yearly lows anticipated for both bitcoin and ether. Ultimately, we’ve highlighted risk for bitcoin to extend declines into the $25,000 area and ether to drop down to the $1800 area before we finally see a breaking away from the risk off correlation. |

| LMAX Digital metrics | ||||

|

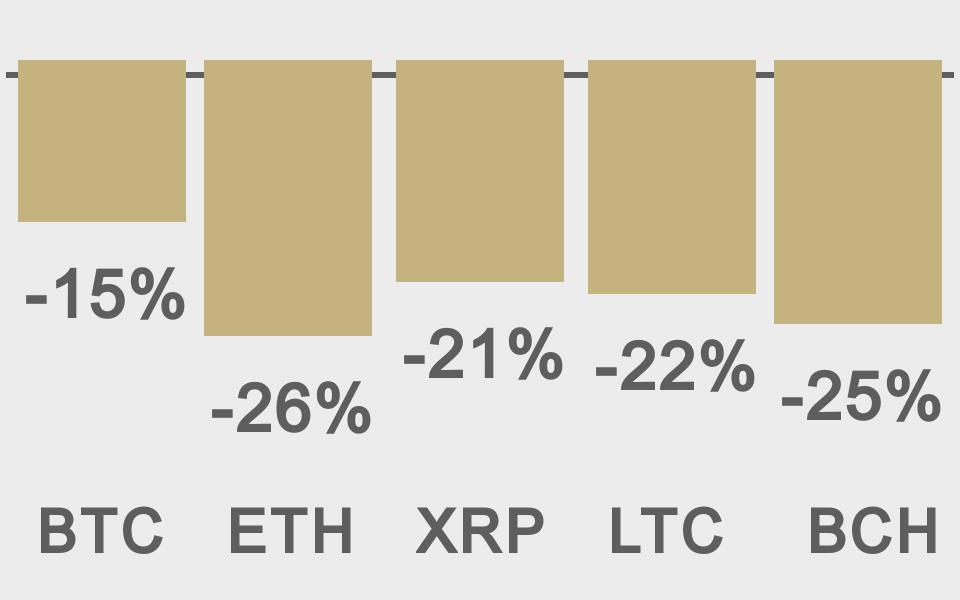

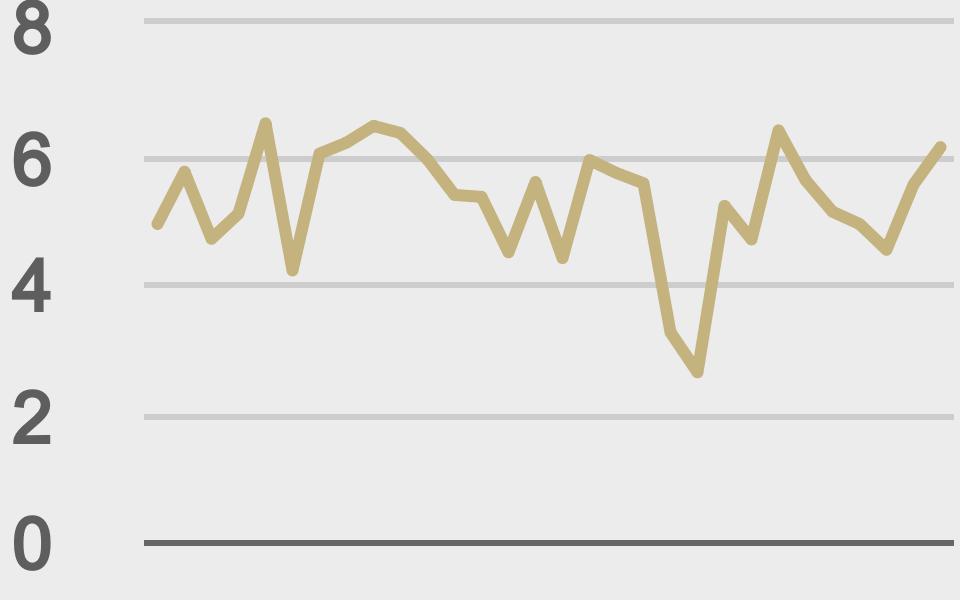

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

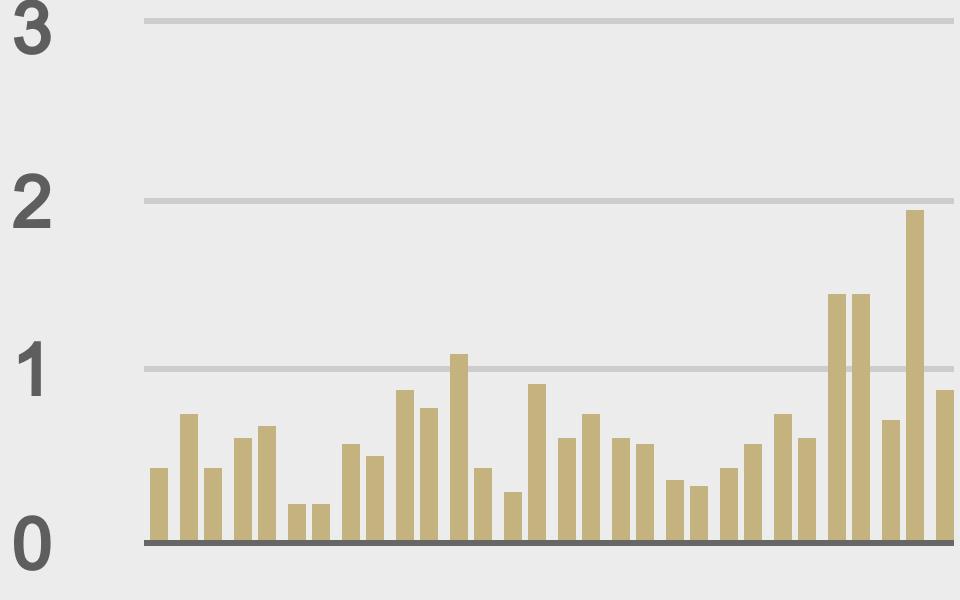

Total volumes last 30 days ($bn) |

||||

|

||||

|

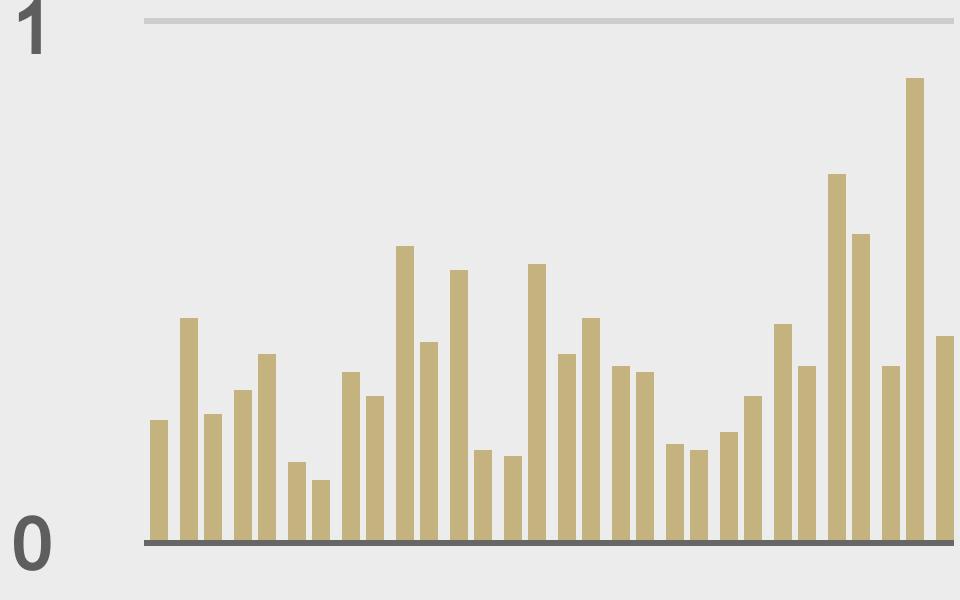

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||