|

|

19 October 2022 Keep an eye on the October highs and lows |

| LMAX Digital performance |

|

LMAX Digital volumes have been trending lower this week, but did show an improvement from Monday. Total notional volume for Tuesday came in at $249 million, 28% below 30-day average volume. Bitcoin volume printed $132 million on Tuesday, 30% below 30-day average volume. Ether volume came in at $95 million, 15% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $5,795 and average position size for ether at 2,596. Volatility has been absent from the market for much of 2022 and is still trending down at yearly low levels. We’re looking at average daily ranges in bitcoin and ether of $642 and $58 respectively. |

| Latest industry news |

|

A recent report from a major bank shows investors pulling out of risk assets in full capitulation mode, while boosting cash holdings to their highest levels since April of 2001. And while we have talked at great length about our expectation that we will see a disconnect in the correlations between crypto and risk assets, we aren’t there just yet, which means such a report could weigh on crypto. Meanwhile, Bloomberg has reported that bankrupt crypto hedge fund Three Arrows Capital is being investigated by US regulators, with the CFTC and SEC looking into whether the fund violated rules by misleading investors about the strength of its balance sheet and not registering with the agencies. The founders’ whereabouts also continue to remain unknown. For today, it will be interesting to see if there is any movement on the back of a wave of inflation data out from some of the major economies. We get UK, Eurozone, and Canada inflation reads today, and if this data deviates significantly from expectation, there is risk it could open a fresh round of volatility. Technically speaking, crypto markets remain confined to exceptionally tight consolidation, with no clear short-term directional insight. Overall, the trend here has been bearish in 2022. But on a short-term basis, we will need to see a break above or below the current October highs and lows in bitcoin and ether to give us a better sense of what could come next. |

| LMAX Digital metrics | ||||

|

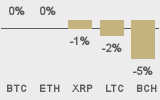

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||