|

|

11 July 2024 Keep an eye on US equities |

| LMAX Digital performance |

|

LMAX Digital volumes were rather light on Wednesday. Total notional volume for Wednesday came in at $265 million, 32% below 30-day average volume. Bitcoin volume printed $164 million on Wednesday, 15% below 30-day average volume. Ether volume came in at $67 million, 55% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,212 and average position size for ether at $5,212. Market volatility is finally showing signs of turning back up after trending lower since March. We’re looking at average daily ranges in bitcoin and ether of $2,404 and $148 respectively. |

| Latest industry news |

|

When it comes to markets, it always comes down to what is priced in and what isn’t. We believe a lot of the downside price action in crypto that we’ve seen in recent weeks has been attributed to a number of factors including a lull post the bitcoin ETF approvals and bitcoin halving event, Mt. Gox related selling, German selling, some US selling, and worry around struggling bitcoin miners. But with all of this now well known and digested by the market, there is a compelling case to argue this downside risk has been fully priced in, leaving room for a healthy recovery in the days and weeks ahead. It’s worth reminding that even with the healthy pullback in crypto assets over the past several weeks, both bitcoin and ether are clear outperformers on a year-to-date basis. Bitcoin and ether are up about 35% year-to-date, while record high, surging US equities are up only 20% by comparison. The crypto market is now waiting for the ETH ETFs to go live, which should act as a positive catalyst. And given the healthy outlook for the space overall, we continue to expect plenty of buying from medium and longer-term players into the dip. Right now, the biggest risk we see to crypto assets is the risk that highly overbought US equities could be on the verge of rolling over. The correlation isn’t absolute by any means, but there is evidence that would suggest a sharp pullback in stocks could weigh on crypto, at least for a moment. With that said, it will be important to keep an eye on today’s US CPI read and tomorrow’s US PPI print for a possible indication of where things could be headed. Should the inflation data come in above forecast, there is risk we could see a bout of profit taking on stocks and a fresh round of risk off flow. Technically speaking, the bitcoin $56,500 previous support level is the key level to watch. While bitcoin holds up above the level on a weekly close basis, the outlook for bitcoin and crypto assets remains highly constructive. |

| LMAX Digital metrics | ||||

|

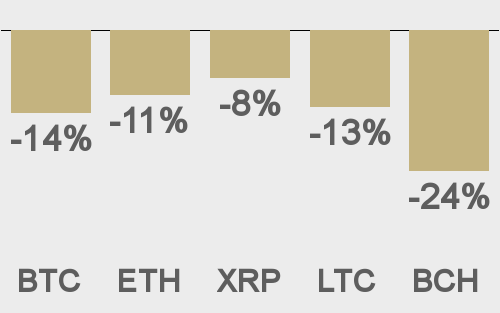

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

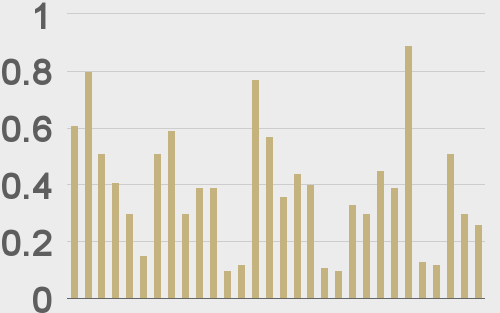

Total volumes last 30 days ($bn) |

||||

|

||||

|

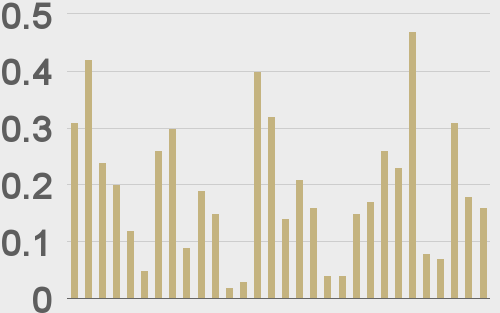

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

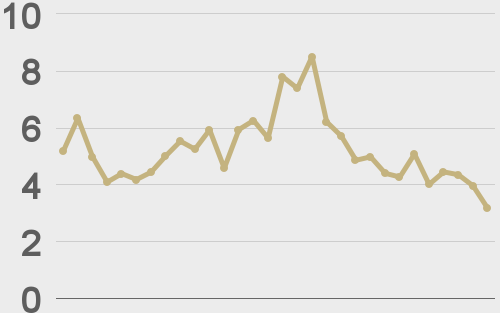

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@WatcherGuru |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||