|

|

6 October 2022 Keeping an eye on that US data |

| LMAX Digital performance |

|

LMAX Digital volumes scaled up nicely overall on Wednesday. Total notional volume for Wednesday came in at $461 million, 14% above 30-day average volume. Bitcoin volume printed $328 million on Wednesday, 44% above 30-day average volume. Ether volume disappointed, coming in at just $91 million, 26% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $6,202 and average position size for ether at 2,598. Volatility has been absent from the market for much of 2022 and is still trending down at yearly low levels. We’re looking at average daily ranges in bitcoin and ether of $837 and $78 respectively. |

| Latest industry news |

|

Softer US data and a recent shift in expectations that the Fed will reconsider its hawkish stance and pivot to less aggressive policy have been helping to inspire renewed risk appetite, which in turn, has been a benefit to crypto assets. Bitcoin traded up to its highest level in three weeks on Tuesday and has since done a good job of holding up above the psychological barrier at $20k. As per our technical insights, we have highlighted a bullish case for the formation of a double bottom. And yet, there is a lot more work that needs to get done to trigger such a bottom. Until then, we are still very much in a well defined downtrend. On the data front, the market will now be looking to see what comes of today’s US initial jobless claims numbers, and more importantly, what happens with Friday’s US jobs report. We are still concerned the market is looking for something it might not get – that being a Fed pivot. And this concern leads us to believe there is more downside risk ahead for risk assets in 2022, which could expose crypto to more weakness before the dust finally settles. But away from conversations around price, developments in the crypto space continue to be highly encouraging and institutional adoption continues to ramp up in 2022. |

| LMAX Digital metrics | ||||

|

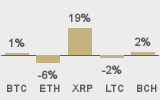

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

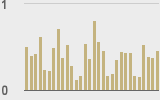

Total volumes last 30 days ($bn) |

||||

|

||||

|

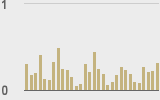

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

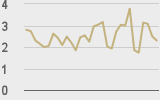

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||