|

|

7 February 2024 Key short-term levels to watch |

| LMAX Digital performance |

|

Trading ranges remain very tight, which continues to result in lower volume in early February. Total notional volume for Tuesday came in at $352 million, 38% below 30-day average volume. Bitcoin volume printed $177 million on Tuesday, 56% below 30-day average volume. Ether volume was however impressive, defying the bitcoin trend, coming in at $127 million, 14% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,512 and average position size for ether at $3,429. Volatility has come down by about 40% since peaking at multi-month highs in January. We’re looking at average daily ranges in bitcoin and ether of $1,324 and $82 respectively. |

| Latest industry news |

|

The bitcoin price remains confined to a tight consolidation into the middle of the week. In our technical overview, we cite key short-term levels to watch in the form of the January 30 high and February 1 low. Absence of any major headlines on the crypto front has left the price waiting for the next catalyst to get things going. But as per our Tuesday commentary, we believe bitcoin and crypto assets have done a good job holding up overall in the face of a wave of broad based US Dollar demand post last week’s less dovish Fed decision and strong US jobs report. These developments have sunk March Fed rate cut odds to 25%, which in turn has resulted in yield differentials moving back into the US Dollar’s favor. On balance, the outlook for bitcoin and crypto assets remains exceptionally bright in 2024. Bitcoin inflows into the new spot ETFs are expected to ramp up significantly in the months ahead. The market is also anticipating the approval of ether spot ETFs later this year, which has translated to a recent run of ether outperformance. Another positive catalyst comes from the bitcoin halving event projected in April. The halving event, where newly minted bitcoin drops by 50%, occurs every four years and has consistently inspired healthy bitcoin bull markets. |

| LMAX Digital metrics | ||||

|

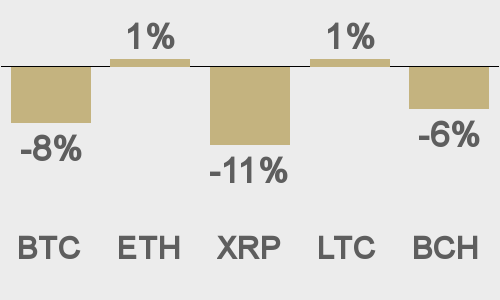

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

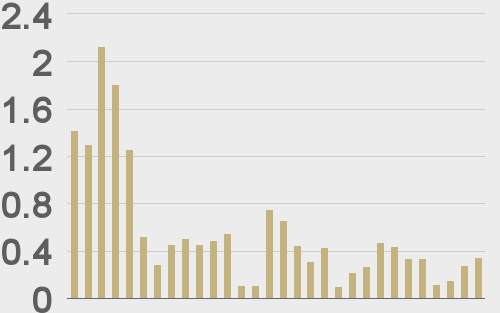

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

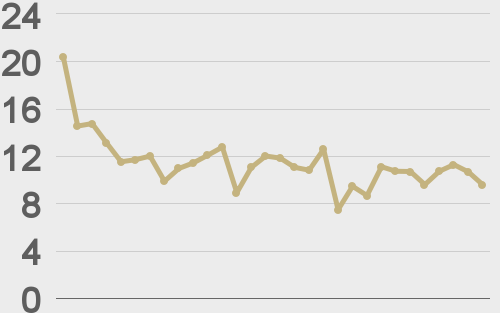

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||