|

|

2 August 2022 Look out for those MicroStrategy earnings |

| LMAX Digital performance |

|

LMAX Digital volumes got off to a strong start this week. Total notional volume for Monday came in at $579 million, 56% above 30-day average volume. Bitcoin volume printed $358 million on Monday, 56% above 30-day average volume. Ether volume came in at $186 million, 78% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $6,402 and average position size for ether at 2,344. Volatility has been showing signs of picking up off yearly lows. We’re looking at average daily ranges in bitcoin and ether of $1,213 and $124 respectively. |

| Latest industry news |

|

We’ve seen steady declines in crypto assets over the past four days, this after a decent break to the topside. The primary driver of the flow has come from all things global macro. There has been renewed worry around a recession in the aftermath of last week’s discouraging US GDP read and this week’s softer US ISM reads. This along with geopolitical tension are resulting in downside pressure on risk assets. Another potential source of weakness is anticipation of not so great second-quarter earning results out from MicroStrategy later today. Analysts are projecting a loss of $7.27 per share. We’ve also highlighted our concern with the recent recovery, given that it hasn’t exactly been accompanied by healthy volume. Glassnode backs this up with its own analysis citing lackluster on-chain transactional demand. |

| LMAX Digital metrics | ||||

|

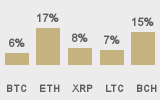

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

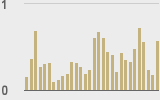

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

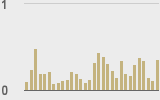

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

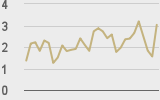

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||