|

|

19 November 2024 Looking beyond $100k |

| LMAX Digital performance |

|

LMAX Digital volumes got off to an impressive start this week. Total notional volume for Monday came in at $837 million, 47% above 30-day average volume. Bitcoin volume printed $489 million on Monday, 33% above 30-day average volume. Ether volume came in at $106 million, 11% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $10,618 and average position size for ether at $3,193. Market volatility has turned up aggressively in recent days. Bitcoin volatility is trading back towards yearly high levels, while ETH volatility is back into the 2024 mid-range. We’re looking at average daily ranges in bitcoin and ether of $3,369 and $153 respectively. |

| Latest industry news |

|

There’s plenty of reason for bitcoin to be wanting to trade higher. The interesting thing here is that it can just as easily trade higher whether we’re staring at risk off market drivers or risk supportive market drivers. On the one side where we’re looking at risk off variables, bitcoin becomes attractive as a store of value asset given its extreme limited supply. On the other side, where we consider a risk on backdrop, bitcoin has the ability to rally as many investors still consider the asset to be a risk correlated, emerging asset. Look no further than recent calls from Goldman Sachs and Morgan Stanley. Goldman Sachs continues to expect gold to run to fresh record highs, while Morgan Stanley has just come out with a bullish call for the S&P500 for 2025. In both of these scenarios, because of how we’ve laid things out, bitcoin should be well positioned to extend its own record run. Calls from investors within the crypto space have been making the rounds as well. These players are now looking past the $100,000 barrier and talking about the next push to $200,000 in 2025. Of course, all of this comes at a time when the market is fully expecting President-elect Trump to deliver on campaign promises for a warm and friendly regulatory environment for crypto assets in the United States. The news of closed meetings with key players in the US market and Trump Media in talks to acquire Bakkt are certainly good signs. Technically speaking, we think it will be interesting to keep an eye on a very beaten down ETHBTC ratio to see if there are any signs of this pairing wanting to bottom out. If we are indeed headed for a warmer regulatory climate, we believe it could open the door for a fresh wave of demand for projects on Ethereum that have suffered from the lack of a clear regulatory framework in the US. |

| LMAX Digital metrics | ||||

|

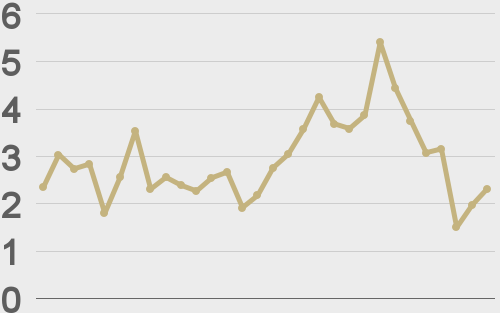

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

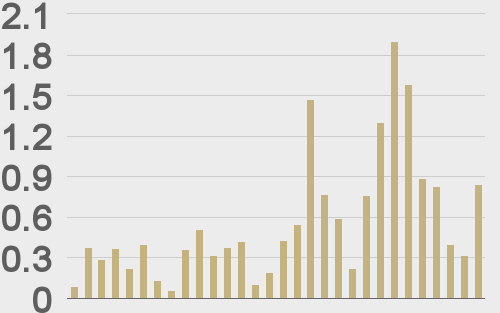

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

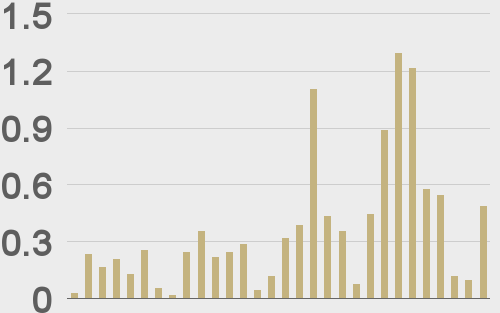

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||