|

| 3 December 2025 Macro relief and regulation boost crypto |

| LMAX Digital performance |

|

LMAX Digital volumes were impressive overall on Tuesday, putting in the strongest performance since November 21. Total notional volume came in at $751 million, 35% above 30-day average volume. Bitcoin volume printed $490 million, 51% above 30-day average volume. Ether volume came in at $141 million, 6% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,097 and average position size for ether at $2,419. Volatility has come down a bit since trading to multi-month highs in October. We’re looking at average daily ranges in bitcoin and ether of $3,887 and $183 respectively. |

| Latest industry news |

|

Bitcoin is leading a broad rebound across digital assets, trading firmly in higher ranges as renewed risk appetite lifts global markets. The primary driver is the market’s growing conviction that the Federal Reserve is preparing to ease policy sooner rather than later. Fed-funds futures are assigning high probabilities to a rate cut next week, sparking a rotation back into risk assets and pushing crypto disproportionately higher. Speculation that Kevin Hassett is emerging as the leading candidate for the next Fed chair is reinforcing that dovish bias, as investors view him as more comfortable with looser financial conditions. Regulatory sentiment is also turning more supportive. SEC Chairman Paul Atkins’ indication that the agency is exploring an “innovation exemption” for digital asset firms is providing a meaningful psychological lift, marking one of the clearest signals this year of a more constructive U.S. regulatory direction. Meanwhile, Vanguard’s decision to allow crypto ETF and mutual fund trading on its platform is being interpreted as another step toward mainstream institutional adoption. Ethereum is benefiting from the same macro and regulatory tailwinds and is seeing pockets of strength across its staking ecosystem. Flows into liquid-staking tokens and scaling networks are picking up as traders position for improving network activity and potential beta catch-up relative to bitcoin. Options markets are showing rising demand for upside exposure into year-end. The combination of the macro relief—supported by dovish Fed expectations, friendlier regulatory developments, and deepening institutional access is creating one of the strongest setups for digital assets in many weeks. |

| LMAX Digital metrics | ||||

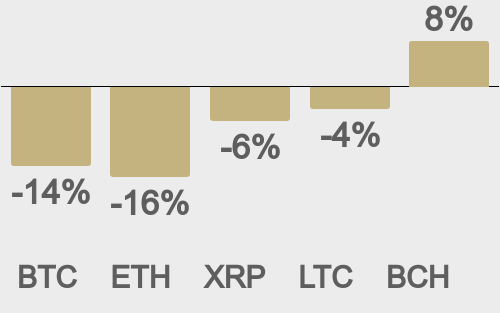

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

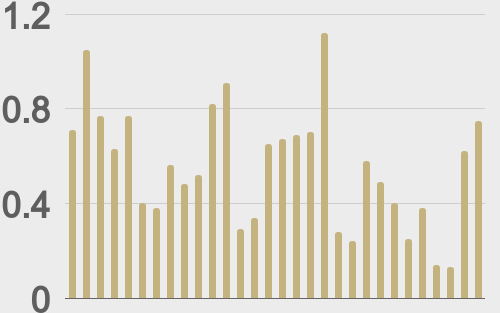

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

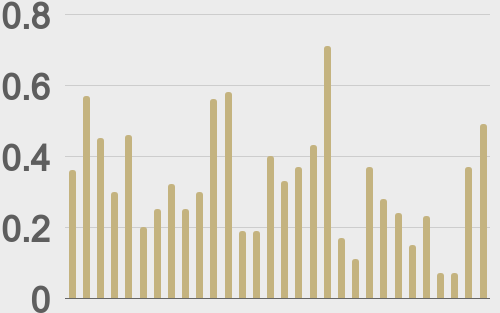

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@CoinDesk |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||