|

| 3 July 2025 Macro tailwinds fuel fresh crypto bid |

| LMAX Digital performance |

|

LMAX Digital volumes recovered nicely on Wednesday after a Tuesday dip. Total notional volume for Wednesday came in at $458 million, 6% above 30-day average volume. Bitcoin volume printed $215 million, 7% above 30-day average volume. Ether volume came in at $137 million, 26% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,865 and average position size for ether at $2,886. Bitcoin volatility is starting to try and turn up from yearly low levels, while ETH volatility has been contained since bottoming in May. We’re looking at average daily ranges in bitcoin and ether of $2,683 and $131 respectively. |

| Latest industry news |

|

Bitcoin continues to be well bid, once again topping $110k, driven by liquidity tailwinds and macro optimism. A U.S.–Vietnam trade deal announcement and a rise in global M2 money supply have acted as potential catalysts, boosting risk-on sentiment and triggering meaningful bitcoin short liquidations. ETH has been even more impressive, outperforming bitcoin. This surge comes in the aftermath of dovish signals from U.S. payroll data and renewed expectations for a July Fed rate cut, which has lifted broader risk assets . ETH’s outperformance reflects its leverage on macro liquidity and its growing narrative as a “tech utility” asset. Crypto markets overall have benefitted from the bitcoin and ETH strength and are higher across the board, underscoring a broad-based rebound. The debut of the U.S.-listed Solana staking ETF highlights Wall Street’s expanding embrace of staking yields alongside core crypto assets. From the macro and geopolitical lens, traditional markets are providing tailwinds. U.S. equities have extended their record run as tech earnings support equity sentiment . Meanwhile, currency dynamics—including dollar weakness amid dovish rate expectations and the U.S.–Vietnam trade pact— are favoring crypto inflows into non-sovereign assets. Technically speaking, a push in bitcoin beyond the May record high at $12,000 will open the door for the next upside extension targeting $145,000. Meanwhile, ETH is focused on a push back above $2,900 so it can get going with its next major upside extension towards $3,500. |

| LMAX Digital metrics | ||||

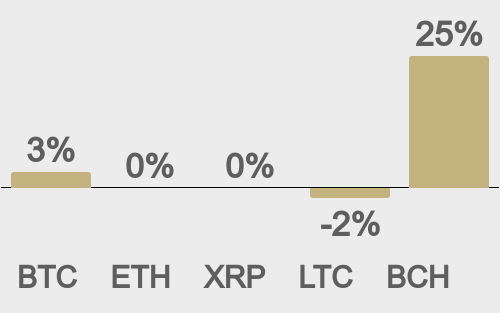

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

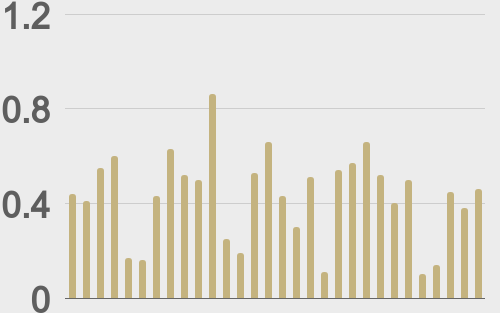

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

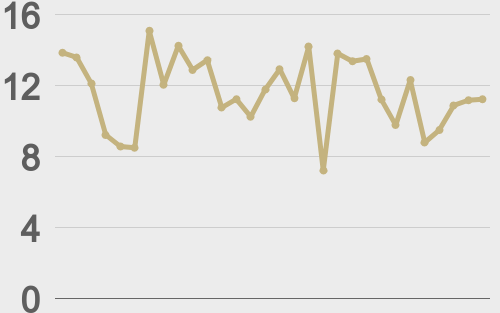

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

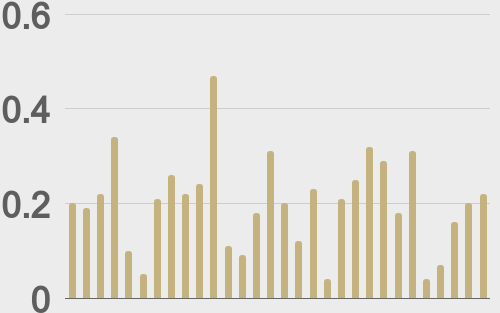

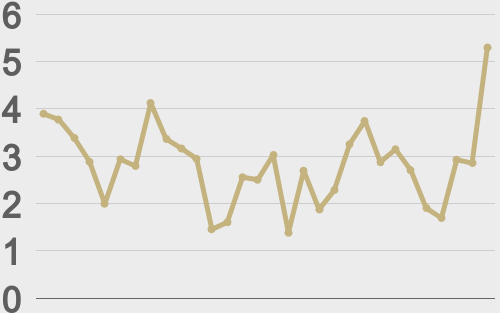

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||