|

|

29 November 2022 Market less distracted by FTX fallout….for now |

| LMAX Digital performance |

|

LMAX Digital volumes got off to another slow start this week. Total notional volume for Monday came in at 228 million, 41% below 30-day average volume. Bitcoin volume printed $137 million on Monday, 38% below 30-day average volume. Ether volume came in at $47 million, 58% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $4,698 and average position size for ether at 2,437. Volatility is showing some signs of life after trading to yearly and multi-month lows. We’re looking at average daily ranges in bitcoin and ether of $644 and $71 respectively. |

| Latest industry news |

|

Crypto asset performance on Monday was consistent with the downbeat vibe in broader markets, which translated to downside pressure on prices. The good news is that crypto assets weren’t confronted with any major shocks from the FTX fallout, which had them focusing back on bigger picture macro themes. And already on Tuesday, we’re seeing a reversal of flow, with improved sentiment resulting in a fresh wave of demand into this latest minor dip. Monday’s setbacks were attributed to unrest out of China and renewed Dollar demand on hawkish Fed speak highlighted by Fed Bullard. There was however a little shakeup on Monday in the crypto world around the credibility of WBTC, but any concerns were quickly addressed by the COO of BitGo, who took to Twitter to assure market participants that each WBTC was backed 1:1 by bitcoin in the company’s cold wallets. Elsewhere, BlockFi finally announced that it had filed for Chapter 11. Interestingly, the SEC is a creditor in this bankruptcy, with $30 million owed as an unpaid balance from a $100 million fine issued back in February of this year. And despite all of the chaos of 2022 and intense price declines, there continues to be plenty of evidence of ongoing institutional adoption, something that should be exceptionally encouraging for the nascent asset class. Technically speaking, there’s been no change since Monday’s update. Bitcoin remains confined to a tight consolidation and we’ll need to see a break of the highlighted support or resistance for a clearer directional insight. |

| LMAX Digital metrics | ||||

|

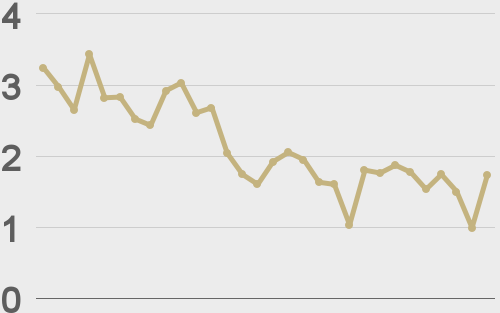

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

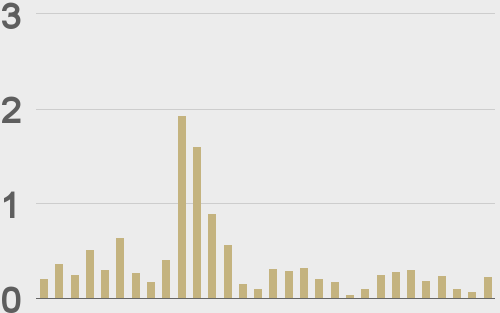

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

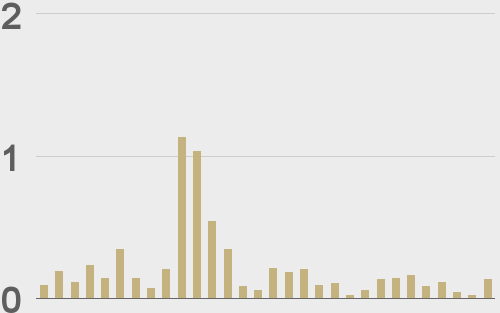

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||