|

|

7 April 2025 Market turmoil unveils golden opportunities |

| LMAX Digital performance |

|

Total notional volume from last Monday through Friday came in at $3 billion, 37% higher than the week earlier. Breaking it down per coin, bitcoin volume came in at $1.7 billion, 31% higher than the previous week. Ether volume came in at $396 million, 5% higher than the week earlier. Total notional volume over the past 30 days comes in at $11.7 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,951 and average position size for ether at $2,551. Bitcoin volatility has fallen back to a recent consolidation range low. ETH volatility has sunk to its lowest levels since November 2024. We’re looking at average daily ranges in bitcoin and ether of $3,648 and $129 respectively. |

| Latest industry news |

|

Global financial markets have been jolted by surging volatility after President Trump’s surprise announcement of steep global tariffs, raising concerns about a potential US recession. This uncertainty has triggered a sharp sell-off in risk-correlated assets, with the effects rippling into the cryptocurrency space. What’s particularly intriguing, however, is that current price levels now present a compelling accumulation opportunity, regardless of the underlying fundamentals. Earlier this year, when bitcoin surged to a new all-time high just shy of $110,000, a correction seemed plausible. Similarly, as stocks climbed to their own record peaks, the potential for a pullback was evident. In assessing where a higher low might emerge for equities and bitcoin, key levels of prior resistance-turned-support came into focus. For the S&P 500, this was the 2022 high around 4,800, while for bitcoin, it was the 2024 peak near $74,000. The weekend’s market turmoil has finally brought these critical zones into play. We’re now looking at medium- and long-term levels that should strongly appeal to both US equity and bitcoin investors. Ethereum, too, trading down toward $1,400, offers a similarly enticing chance to accumulate. It’s often said that fundamentals find a way to align when technical signals become undeniable—and right now, the technical setup is loudly hinting at a bullish reversal. While the exact fundamental trigger remains unclear, it wouldn’t be surprising to see easing tensions around global trade or supportive moves from major central banks pave the way. For now, the stage is set, and the opportunity is hard to ignore. |

| LMAX Digital metrics | ||||

|

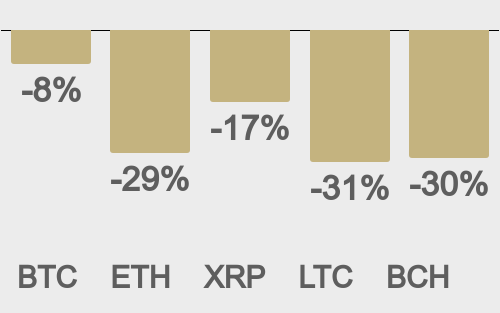

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

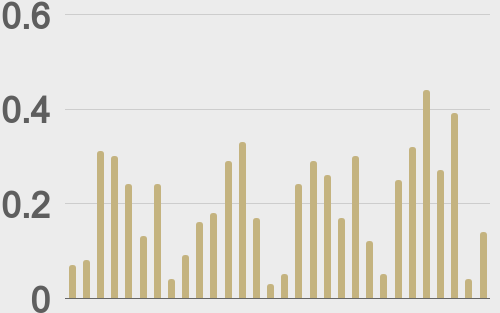

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

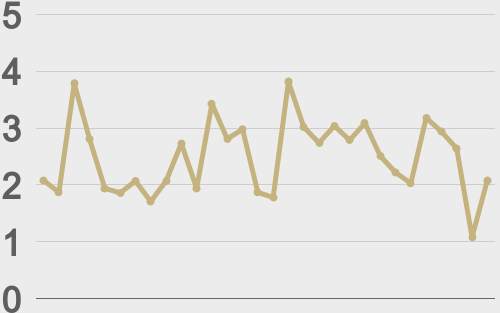

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@woonomic |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||