|

|

1 February 2022 Maybe one more drop before big bullish reversal |

| LMAX Digital performance |

|

LMAX Digital volume has cooled off to start the week. Total notional volume for Monday came in at $586 million, 22% below 30-day average volume. Bitcoin volume printed $313 million on Monday, 18% below 30-day average volume. Ether volume came in at $191 million, 28% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,531 and average position size for ether at 5,353. Volatility has been trending lower as we come into 2022. We’re now looking at average daily ranges in bitcoin and ether of $2,355 and $233 respectively. |

| Latest industry news |

|

The year is officially getting going with January behind us and on the books. It wasn’t a great start to the year for crypto, with bitcoin down 17% in January and ether off 26%. This also follows weakness that we had been seeing to close out 2021. As far as ether underperformance through this period goes, the price action can be reconciled by the fact that ether has a stronger sensitivity to risk sentiment and is therefore more exposed than bitcoin in periods of risk off. One important takeaway as far as this latest pullback in crypto goes (relative to many of the previous pullbacks) is that it has been driven by macro fundamentals rather than any crypto specific events. We feel this adds credibility to the asset class. We have seen some evidence of this in the past, namely back in March of 2020, and we think this is reflective of a market that is finally seeing major adoption. Having said that, we also believe this latest pullback has seen the worst of its days, and though we aren’t ruling out one more decent drop, we believe we should soon see both bitcoin, ether (and the broader crypto space) start to be very well supported for a run back to the topside. Soon enough, the focus will shift back to crypto specific drivers. Many have been concerned about regulatory hurdles that will need to be overcome. While we concede this will be cause for some turbulence, we believe the outlook here is bright and the mass adoption will help to ensure a smoother and fairer path to regulation. |

| LMAX Digital metrics | ||||

|

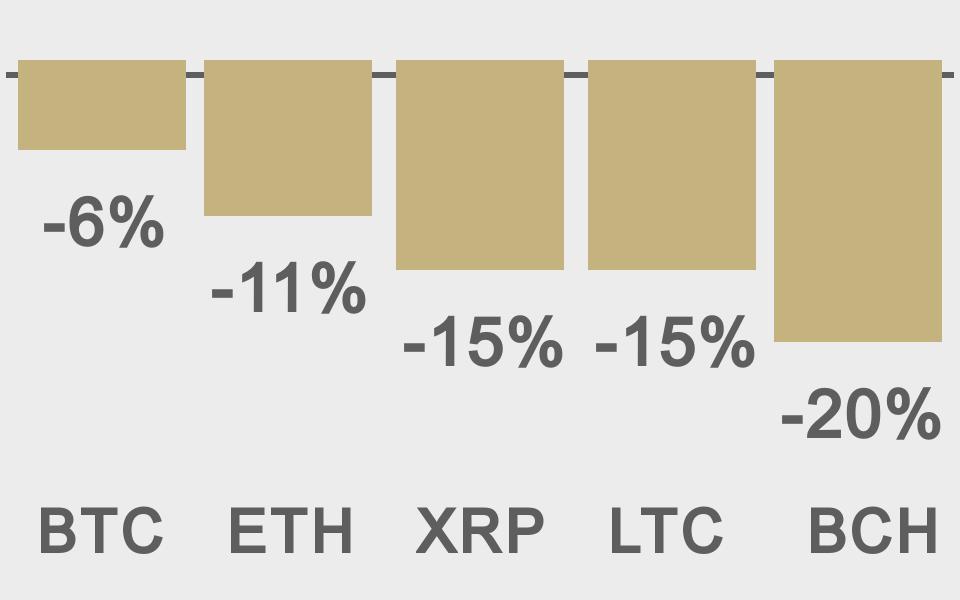

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

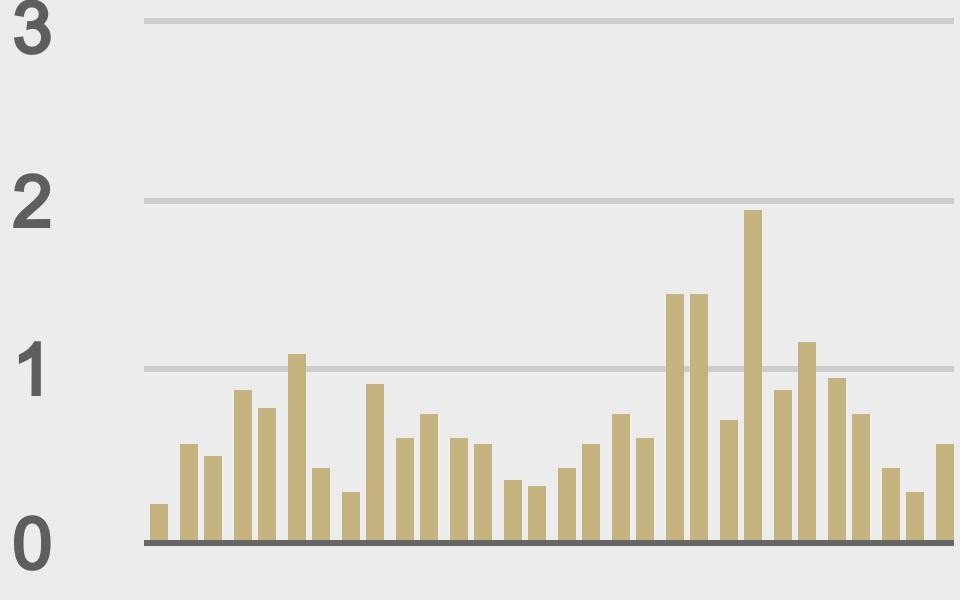

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

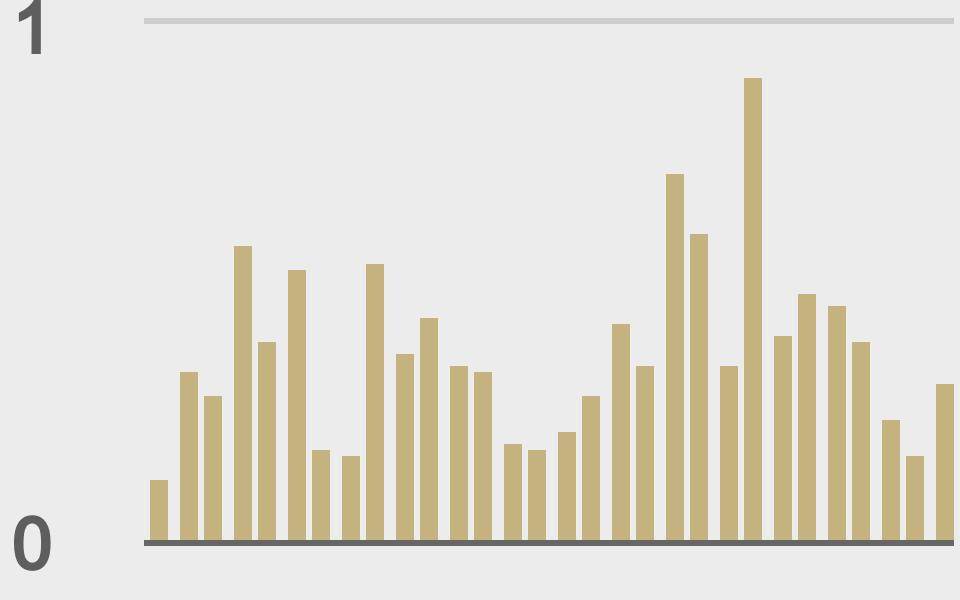

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||