|

|

13 May 2024 Minor correction within strong uptrend |

| LMAX Digital performance |

|

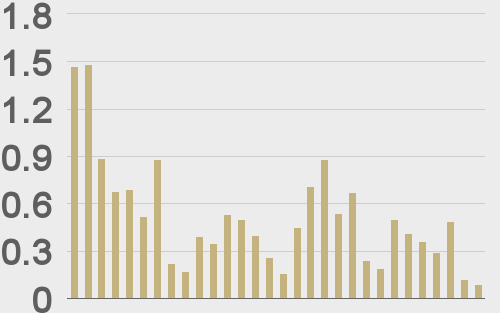

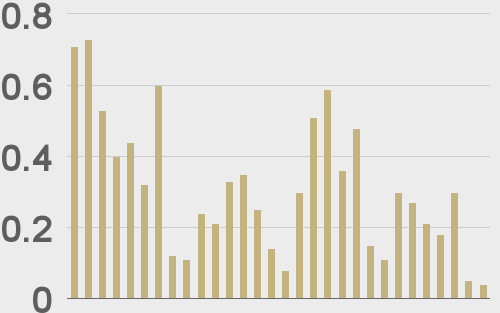

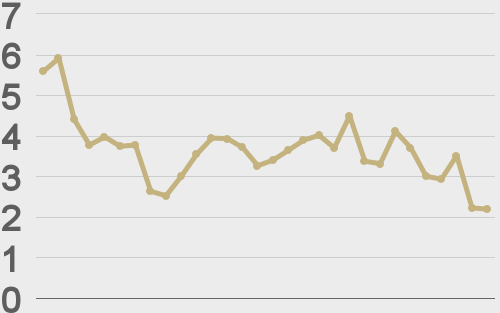

Total notional volume at LMAX Digital cooled off in the previous week. Total notional volume from last Monday through Friday came in at $2.05 billion, 37% lower than a week earlier. Breaking it down per coin, bitcoin volume came in at $1.3 billion in the previous week, 44% lower than the week earlier. Ether volume came in at $454 million, 36% lower than the week earlier. Total notional volume over the past 30 days comes in at $15.5 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,882 and average position size for ether at $4,081. Market volatility has come down by about 40% since peaking in March. We’re looking at average daily ranges in bitcoin and ether of $2,603 and $141 respectively. |

| Latest industry news |

|

Crypto assets are in a period of correction and cooldown after an impressive Q1 that resulted in a fresh record high for bitcoin. Clearly, the buzz around the bitcoin ETF launches and bitcoin halving event has faded away and absence of any meaningful short-term fundamental catalysts has translated to a less exciting market. Most of the attention of late has been on updates in the world of traditional markets where there has been a clear push back towards a monetary policy easing bias. On net, such a shift could translate to a sustained period of broad based US Dollar outflows, which in turn could then serve to prop crypto assets. As far as deal flow into the crypto space goes, things have been looking good. If we look at total funding into the space over the past week, there’s been a 58% rise from the previous week to just over $200 million in funding. Technically speaking, it’s important to take the latest round of setbacks with a grain of salt. As per today’s chart update, if we look at the bitcoin weekly chart, it’s clear the pullback is only a minor dip within a very well defined uptrend. |

| LMAX Digital metrics | ||||

|

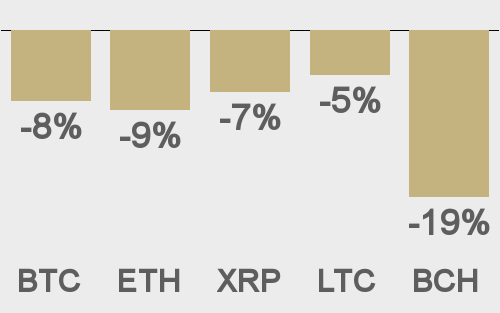

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||