|

|

21 August 2024 More about the relative weakness |

| LMAX Digital performance |

|

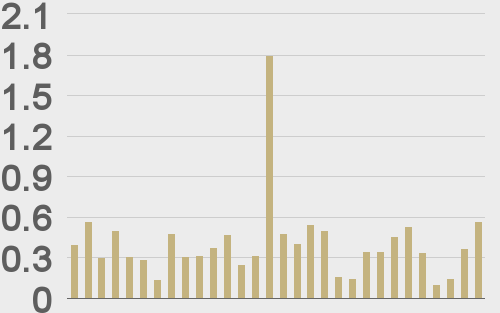

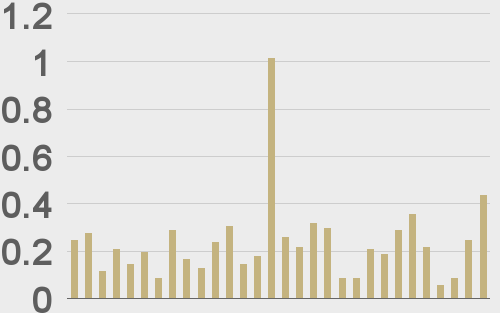

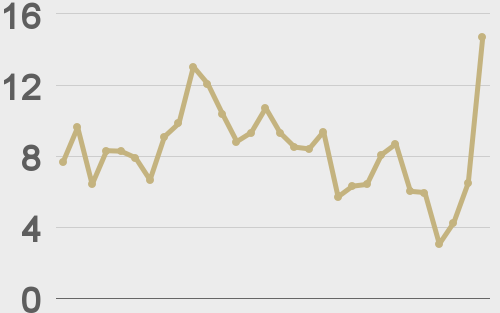

LMAX Digital volumes were up a healthy amount overall on Tuesday. Total notional volume for Tuesday came in at $568 million, 39% above 30-day average volume. Bitcoin volume printed $440 million on Tuesday, 83% above 30-day average volume. Ether volume came in at $81 million, 26% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,413 and average position size for ether at $3,271. Market volatility has cooled off after an impressive run higher in early August. We’re looking at average daily ranges in bitcoin and ether of $2,785 and $150 respectively. |

| Latest industry news |

|

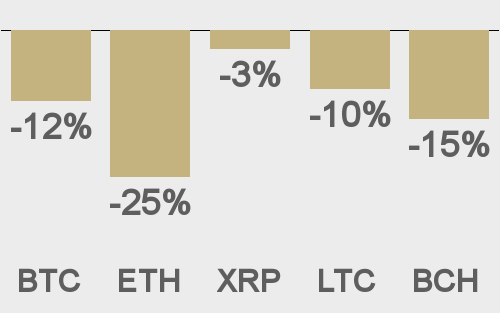

Many out there have been struggling to reconcile price action in the crypto market over the past several days. Macro conditions have certainly been quite favorable and yet crypto assets have been chopping around despite higher stocks and a lower US Dollar. The first thing we would highlight here is that it’s important to not get too carried away with this. After all, we’re in thinner summer conditions for many a trader and it would be unfair to read too much into a week or so of price action. But if we were to try and pin it down, we would assign three factors to the relative underperformance. We’ve already talked about a period of adjustment in the aftermath of the ETH ETFs going live. This was the case when the bitcoin ETFs went live earlier this year and we believe we are seeing this play out again with the ETH ETFs. We don’t believe this should last much longer and already into September things should smooth out on this front. The second factor is seasonality. When we look at historical performance in crypto assets, August has not been a great month. The analysis shows the market having a tougher time at this time of year, with stronger demand not picking up until end of September. Finally, we believe some of the relative weakness could be coming from US government related selling of bitcoin from the Silk Road seizure. There has been a lot of speculation around this after the US government moved 10,000 of bitcoin last week. Overall however, any such selling isn’t expected to last much longer and won’t do anything to change the highly constructive outlook for bitcoin and crypto assets. |

| LMAX Digital metrics | ||||

|

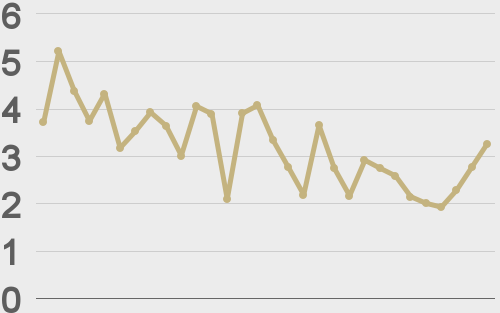

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||