|

|

25 July 2023 More technical than fundamental |

| LMAX Digital performance |

|

LMAX Digital volumes were up overall on Monday. Total notional volume for Monday came in at $366 million, 7% above 30-day average volume. Bitcoin volume printed $252 million on Monday, 29% above 30-day average volume. Ether volume came in at $68 million, 21% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,734 and average position size for ether at 2,948. Volatility has traded down towards yearly low levels after an impressive run higher in June. We’re looking at average daily ranges in bitcoin and ether of $784 and $55 respectively. |

| Latest industry news |

|

Monday’s bearish bitcoin price action was a significant short-term development given the breakdown below multi-day consolidation support. As per our technical insights, this opens the door for a deeper setback towards $25k in the sessions ahead. Fundamentally, there really hasn’t been all that much to assign to the weakness, which has extended beyond bitcoin into the rest of the cryptocurrency market. Ongoing worry around an SEC appeal of the Ripple case and uncertainty on the regulatory front have been thorns at the side of the market, though as per our analysis, we remain optimistic that all will resolve well for the space in time. As far as the SEC appeal goes, we highlighted the other day that such an appeal would take many months if not years before a decision were made, and even then, there would still be room for the courts to rule in favor of XRP as a non-security. On the regulatory side, efforts are being made to push for a more sensible framework where key players in the crypto space are working together with lawmakers to come up with a solution that is both more sensitive to, and has a better handle on the intricacies of decentralized assets. As far as this week goes, we believe we will see more focus on the wave of central bank risk which begins with tomorrow’s highly anticipated Fed decision. Indeed, correlations with risk on flow have been less relevant of late. But at the same time, we worry that any intense risk off flow resulting from a more hawkish leaning Fed decision, could very well weigh on the price of bitcoin and the rest of the crypto market by extension. Of course, one development which we believe would more than offset any negative fallout from a post-Fed meltdown, would be the approval of the BlackRock bitcoin ETF. Market participants are increasingly optimistic this approval will go through, though there is also enough doubt that the event is not even close to fully priced in. Such an approval is likely to usher in a major wave of institutional adoption, which in turn, should put plenty of upwards pressure on the price of bitcoin. And naturally, we expect the rest of the crypto market will benefit from the positive momentum. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

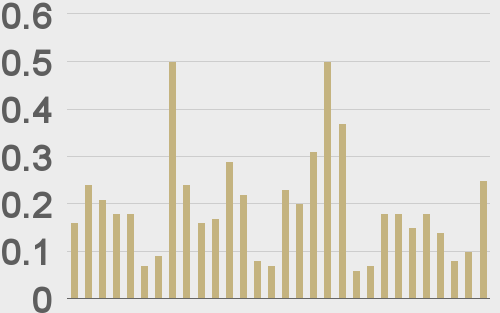

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@VitalikButerin |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||