|

LMAX Digital metrics |

||||

|

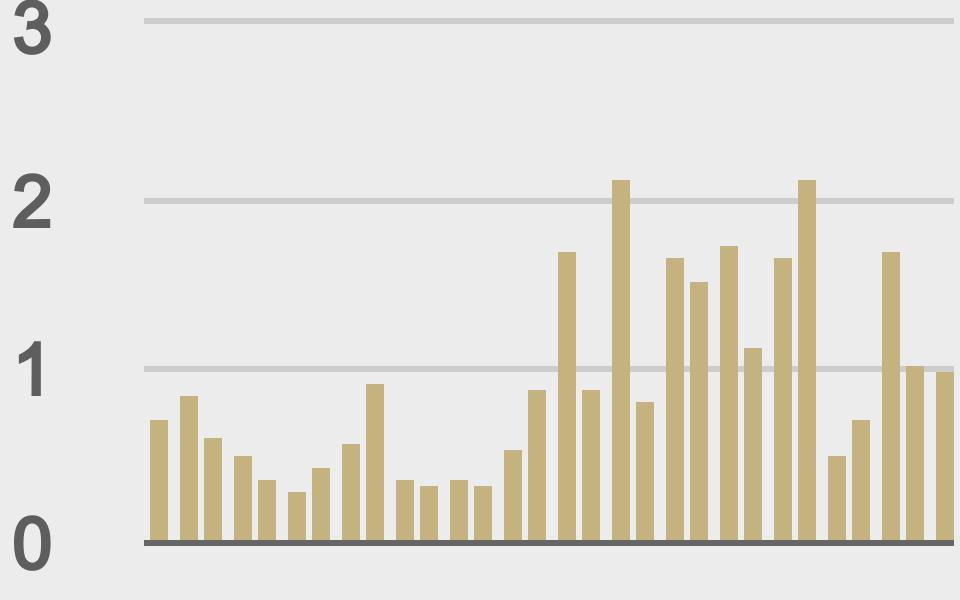

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

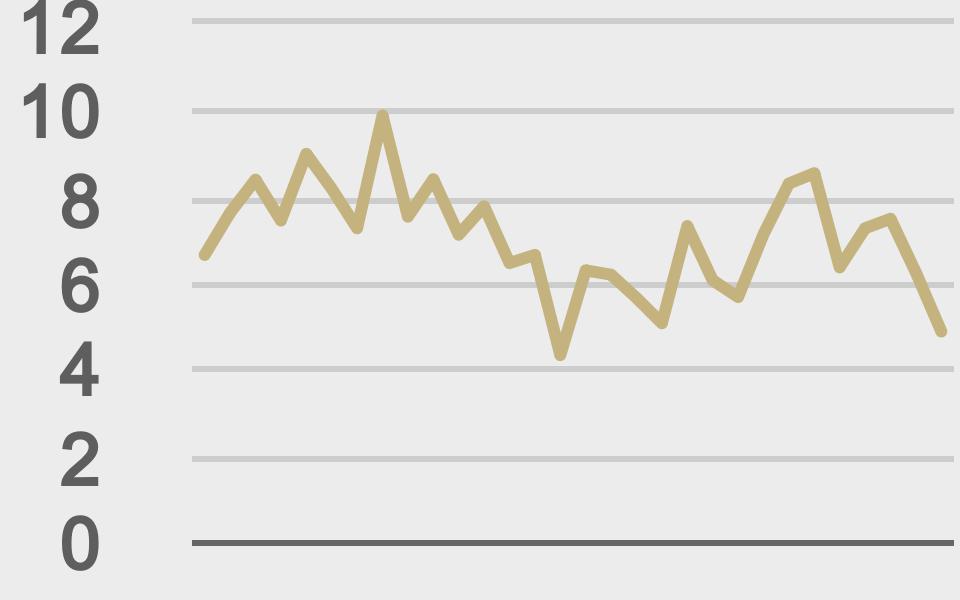

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

|

||||

|

@CoinDeskData Countries spend energy on a lot of things. However, what countries do not spend tons of energy on is a global, trustless, and permissionless payment settlement network. Don’t believe us? Take a look at this chart. |

||||

|

@DocumentingBTC The island of Bequia to become the world’s first fully #Bitcoin-enabled community. #Bitcoin will be accepted for everything, from real estate to the grocery store. |

||||

|

|

| Next big move could be lower |

| LMAX Digital performance |

|

LMAX Digital volumes were quite healthy on Wednesday. Overall volume came in at $1.63 billion, just 1.4% lower than average total volume over the past 30 days of $1.65 billion. Still, both bitcoin and ether volumes were above their 30 day average volumes, at +6% and +8% respectively. We also saw a nice jump in overall volume from Tuesday, mostly attributable to resurgence in demand for Ether which has been extending its run of record highs against the US Dollar. Ether volume shot up 31% on Wednesday from the previous day, coming in at $397 million. Ether has been the strongest performer out of the major cryptocurrencies over the past 30 days, up 21.4% against the Buck. This compares with bitcoin, which is actually down 5% over that time. |

| Latest industry news |

|

Ether is the cryptocurrency really turning heads in 2021. Ether has extended its record run of gains, all while bitcoin remains in a state of consolidation since topping out at its record high back on April 14th. Year to date, ether is up 265% against the US Dollar, as compared to bitcoin, up 84% against the Buck. It seems investors who took on exposure to bitcoin in recent months are now looking for other areas to diversify their crypto exposure. Given Ethereum’s different value proposition, there has been great interest in the currency driving this alternative blockchain. Ether is also a prime beneficiary of Fed policy which continues to incentivize investment in risk assets. Whereas bitcoin is viewed as a story of value asset, Ethereum is the blockchain driving innovation in the cryptosphere and it therefore makes sense to see its currency outperforming in such favourable market conditions. But ether also has a way of being a laggard to bitcoin price action and with the currency so extended and Fed Chair Powell warning of froth in risk assets, making specific reference to dogecoin, we would caution against expectations for the run to extend much further at this stage. |