|

|

| No love from Fed Kashkari |

| LMAX Digital performance |

|

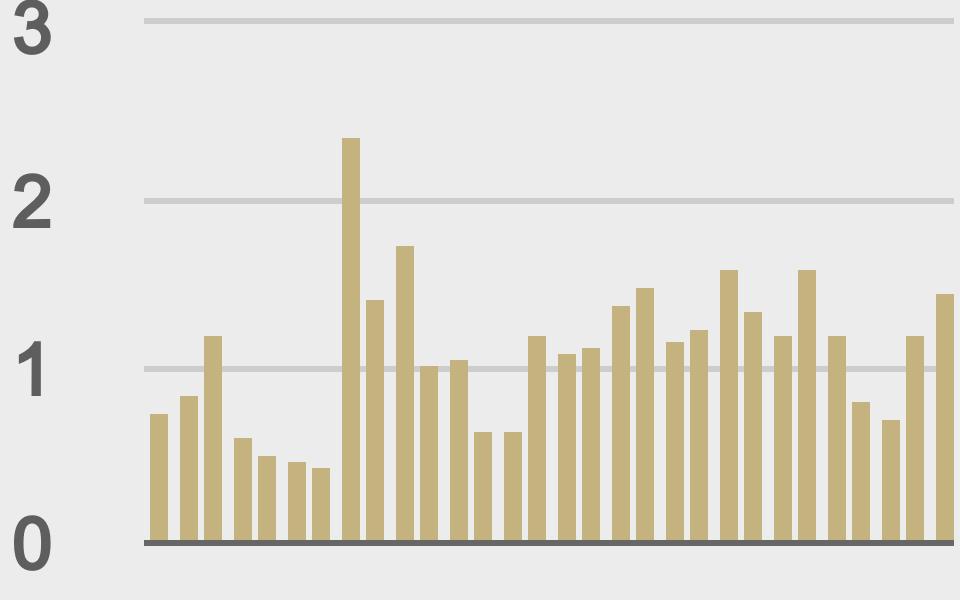

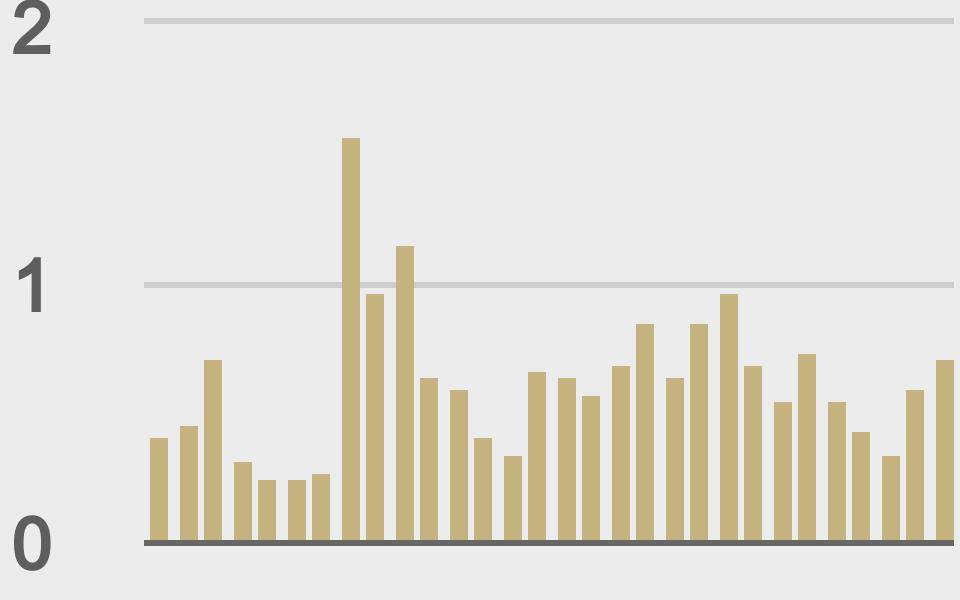

LMAX Digital volumes were up across the board on Tuesday. Total notional volume came in at $1.45 billion, 28% above 30-day average volume. This was the 19th consecutive day of total notional volume coming in above a yard and continues to reflect a very healthy market looking to trend back towards record volumes from earlier this year. After coming in flat on Monday, bitcoin volume shot up Tuesday, coming in at $710 million, 12% above 30-day average volume. Meanwhile, ether continued to be the more active of the two, with volume coming in at $450 million on Tuesday, 57% above 30-day average volume. Total notional volume at LMAX Digital over the past 30 days comes in at $34 billion. |

| Latest industry news |

|

Crypto assets have stalled out after an impressive breakout the other week, and it seems as though concerns about global growth and a downturn in the US equity market are concerns that are weighing on prices. Despite medium and longer-term expectations for these assets to hold a store of value, shorter-term, they are still considered by many to be emerging markets exposed to downturns in periods of risk off. Geopolitical tension, COVID contagion, and rising inflation are all factoring into the price action and we suspect there could be more weakness ahead resulting from all of this downside risk. On Tuesday, Fed Kashkari didn’t help matters, after coming out in opposition to cryptocurrencies, while adding he did not believe bitcoin could serve as a safe haven from inflation risk, particularly the kind of inflation seen in developing countries. Technically speaking, the outlook is more constructive since bitcoin broke back above $41,000. The next key resistance point comes in at the $50,000 psychological barrier, and a break above will be required to open the door for the next upside extension towards a retest of the record high. |

|

LMAX Digital metrics |

||||

|

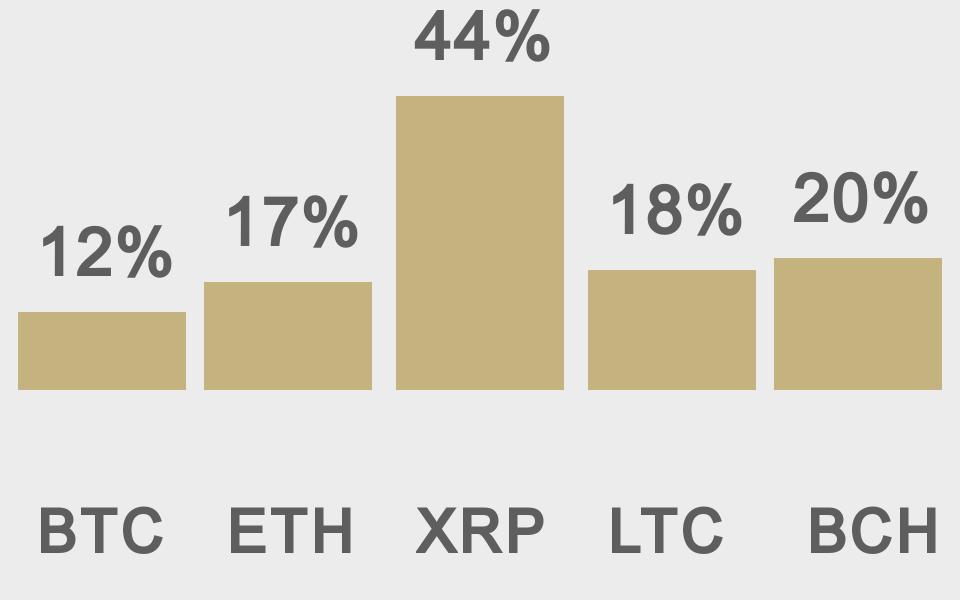

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

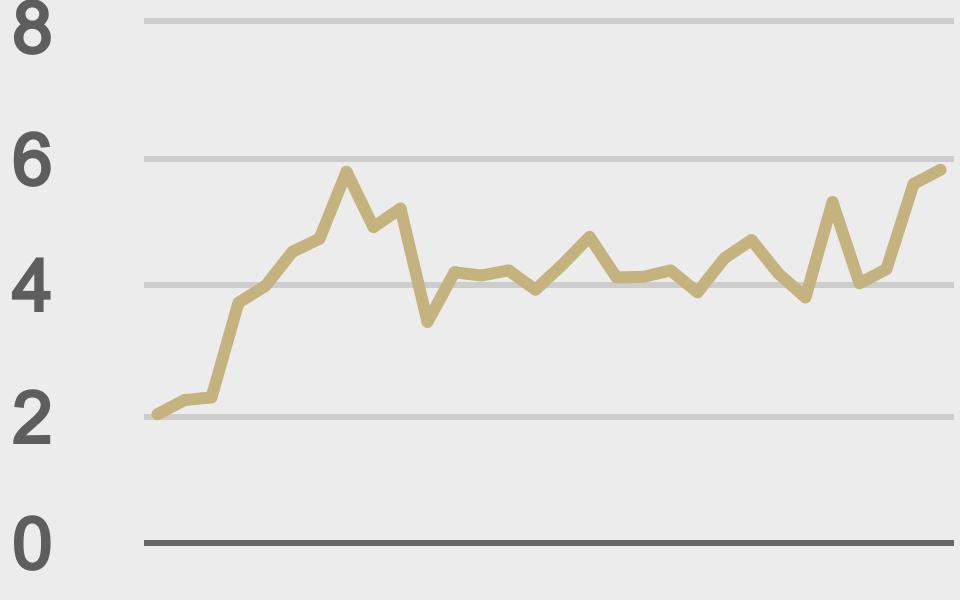

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@TheMoonCarl |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||