|

|

11 March 2025 Not much more pain from here |

| LMAX Digital performance |

|

LMAX Digital volumes got off to a strong start this week. Total notional volume for Monday came in at $768 million, 57% above 30-day average volume. Bitcoin volume printed $306 million on Monday, 33% above 30-day average volume. Ether volume came in at $234 million, 138% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,966 and average position size for ether at $1,589. Bitcoin volatility is tracking at peak levels, while ETH volatility has been more contained. We’re looking at average daily ranges in bitcoin and ether of $4,968 and $206 respectively. |

| Latest industry news |

|

The pullback we’ve been seeing in the crypto market is a lot easier to digest if you’ve been keeping up with our commentary. The bottom line here is that irrespective of whatever might be going on in the news, bitcoin has been due for a healthy pullback since pushing to a fresh record high up towards $110k in January. The fact that the move has been accompanied by a wave of risk off flow in global markets has only made the fallout that much more intense for the rest of the crypto market, given its more credible sensitivity to risk appetite. As per our technical insights, bitcoin is finally close to arriving at a critical support zone that should act as the next major higher platform ahead of a bullish continuation to fresh record highs. If we are to consider the fundamentals, it has become overwhelmingly apparent that the latest declines can be attributed to global macro flows. Investors have become increasingly unsettled with the outlook for the US economy at a time when economic data has been more sluggish, trade wars are becoming a legitimate concern, and the US administration keeps on a path of unpredictable policy. But as we have highlighted many times, bitcoin correlations with US equities need to be taken with a grain of salt. Indeed, there is a group of market participants who see bitcoin as a risk correlated emerging asset. And so, for these market participants, there is a desire to sell bitcoin when stocks come under pressure. At the same time, there is a more prominent group of bitcoin holders who view the asset as a compelling store of value, given its properties that are far more analogous to gold than stocks. This second group is the group that should keep bitcoin supported into this dip, as these players look to step in and take advantage of an attractive discount in price. Looking ahead, as far as the macro goes, we believe trade tensions will cool off, investors will become less stressed about the daily headlines out of the White House, and the Fed will finally start bending back towards more investor friendly accommodative policy gestures. All three of these things should do a good job inspiring renewed demand for risk assets, which certainly won’t be a bad thing for crypto assets. |

| LMAX Digital metrics | ||||

|

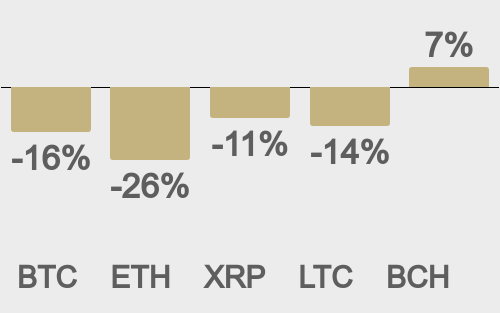

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

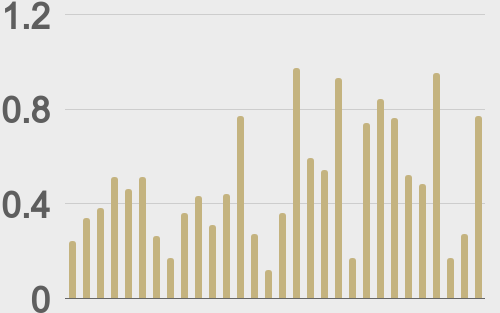

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

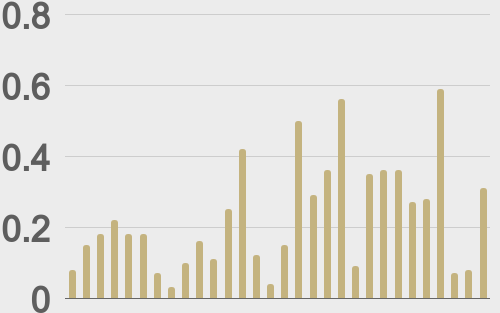

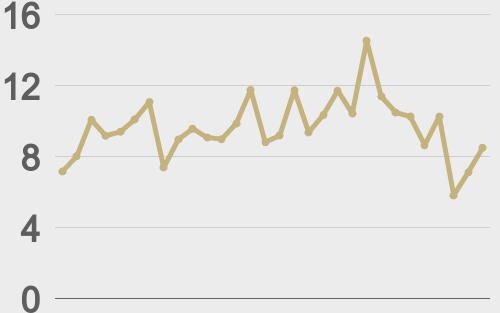

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||