|

|

7 February 2022 Not out of the woods just yet |

| LMAX Digital performance |

|

Total notional volume at LMAX Digital was down in the previous week. Total notional volume from Monday through Friday came in at $4 billion, off 31% from a week earlier. Breaking it down per coin, Bitcoin volume came in at $2.3 billion in the previous week, off 16% from the week earlier. Ether volume came in at $1.4 billion, off 43% from the week earlier. Total notional volume over the past 30 days comes in at $23 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,958 and average position size for ether at $5,350. Volatility has cooled off in recent weeks after topping out in December. We’re now looking at average daily ranges in bitcoin and ether of $2,067 and $198 respectively. |

| Latest industry news |

|

We’ve spent quite a bit of time talking about how we think the correlation of ‘risk off-crypto off’ is a correlation that will become less relevant in the weeks ahead. At the moment, there is still a relationship between downturns in global sentiment and the negative impact on crypto as an asset class given the emerging market properties of crypto. At the same time, there is far too much going on in the space to ignore with respect to the longer-term value proposition. Last week, we did see some evidence of the breakdown of this correlation. Stocks were falling late in the week, all while there was an impressive wave of demand for crypto. Of course, this was only over the course of a couple of sessions, so we shouldn’t read too much into it just yet. Nevertheless, there is no denying the tremendous demand for crypto assets into this latest dip. As far as the outlook from here goes, the big level to keep an eye on is the bitcoin high from mid-January at $44,455. This level represents a minor lower top within the existing downtrend off the record high. If it can be breached to the topside, it could help shift momentum back in bitcoin’s favour, which would likely spillover into the rest of the crypto market. Still, we’re not convinced we’re there just yet, especially after Friday’s jobs report out of the US. On Friday, the NFP number was very strong, and hourly earnings came in hot. All of this points to a less investor friendly Fed path going forward, which could once again weigh down on stocks and then weigh on crypto by extension. So while the outlook is looking more upbeat, we’re not out of the woods just yet. |

| LMAX Digital metrics | ||||

|

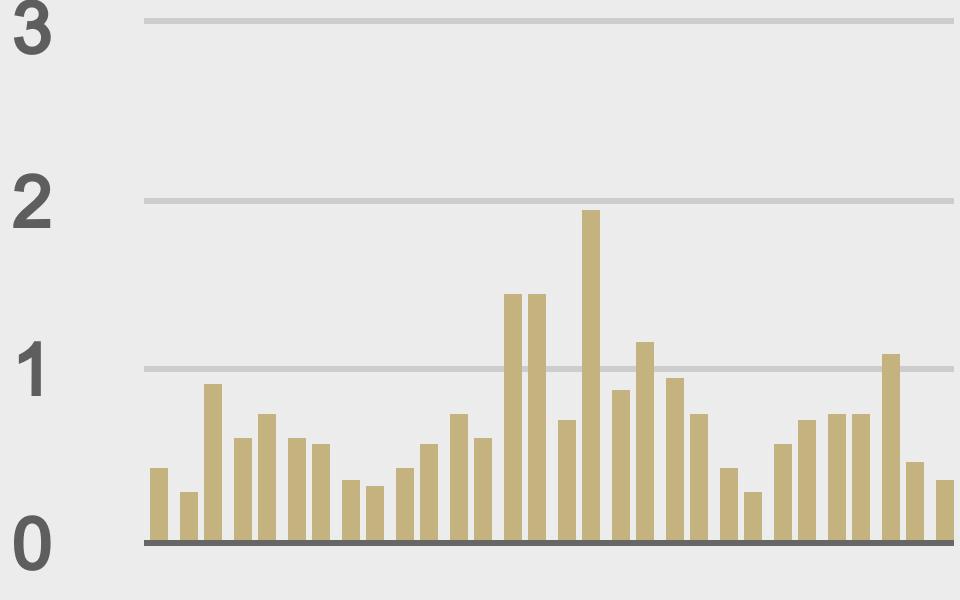

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

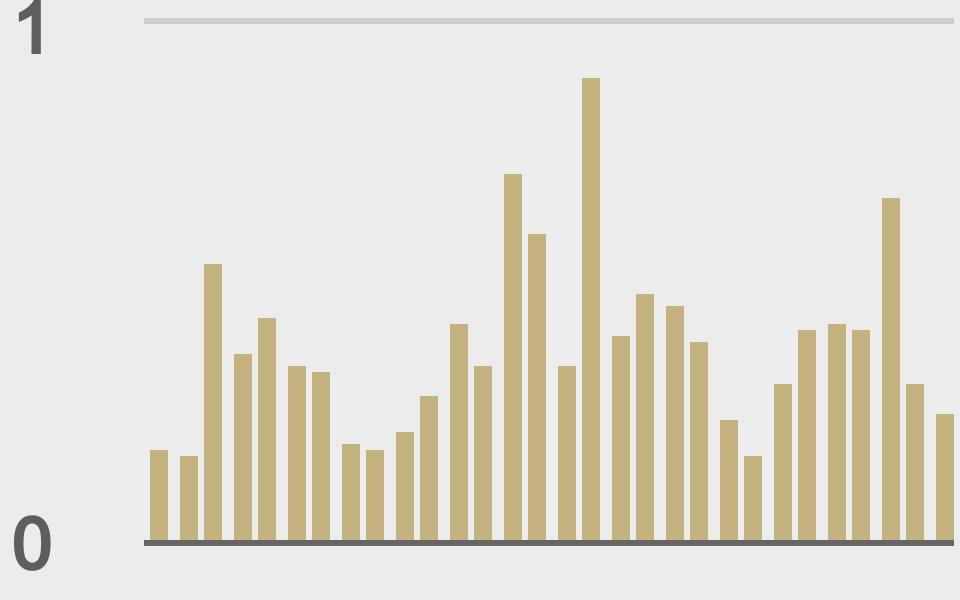

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

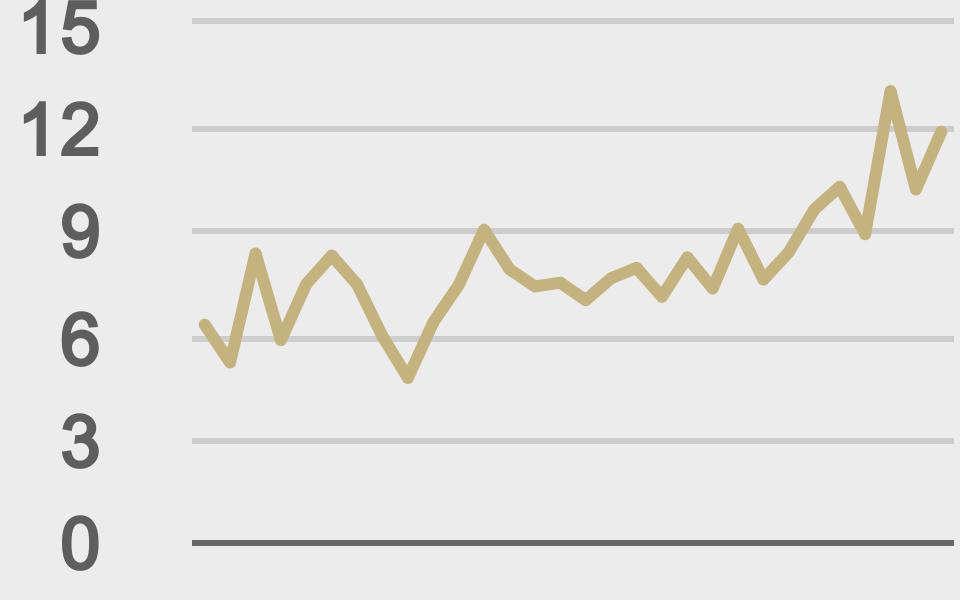

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

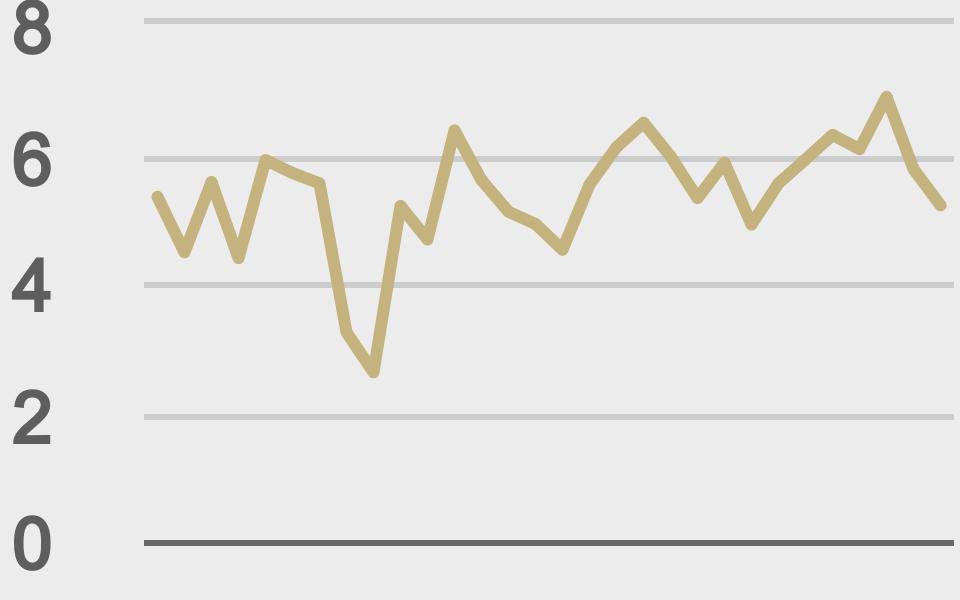

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@iamjosephyoung |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||