|

|

| Not out of the woods yet |

| LMAX Digital performance |

|

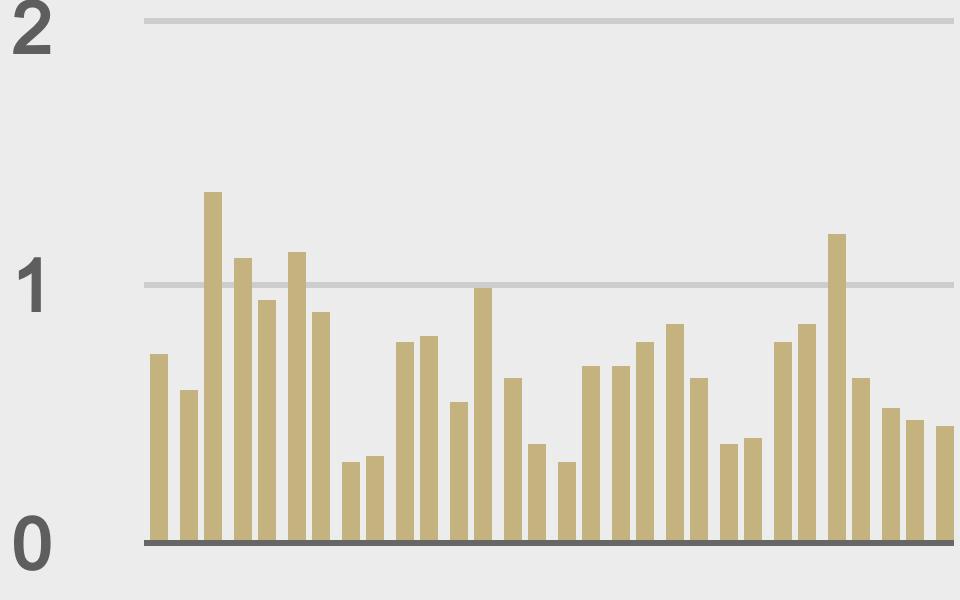

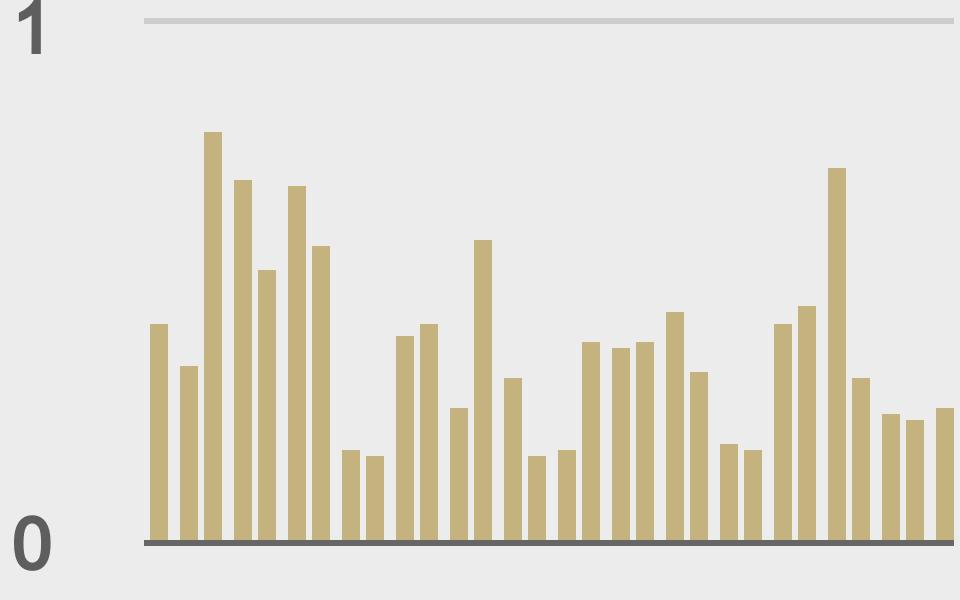

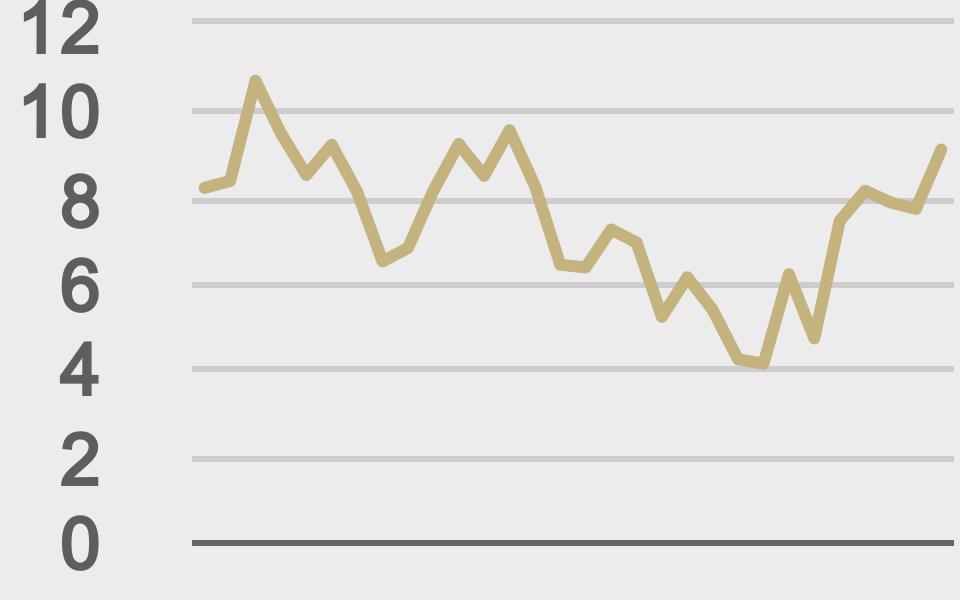

Volume at LMAX Digital has picked up in a big way over the past week or so. Last week, we saw the first push above $1 billion in total notional volume in well over a month and the positive momentum carried over into weekend trade as well. Saturday and Sunday total notional volume combined came in at $942 million, this some 19% above the previous weekend volume. Total notional volume at LMAX Digital over the past 30 days comes in at $21.5 billion. Average trading sized for bitcoin and ether have also picked up quite a bit. Average trading size for bitcoin came in at $9,081 on Sunday, 23% above average 30-day trading size. Average trading size for ether came in at $4,673 on Sunday, 50% above average 30-day trading size. |

| Latest industry news |

|

We’ve seen an impressive recovery in crypto over the past week or so, with both bitcoin and eth soaring since bottoming out last Tuesday. A lot of the demand seems to have come on the back of ‘The B Word’ virtual event, in which Elon Musk mentioned his holdings of bitcoin and ether, while talking up the defi space. Cathie Wood and Jack Dorsey were also not shy about their own bullishness in the space. Another exciting development getting some buzz is around Amazon’s listing for a role of ‘Digital Currency and Blockchain Product Lead’ at the firm. This isn’t Amazon’s first job listing in the space either and only helps to solidify overall support for crypto assets from larger institutional names. Goldman Sachs has also helped drive demand, talking up Ethereum and revealing poll results that show half of family office clients wanting to take on crypto exposure. But technically speaking, we do need to be careful about getting too carried away with all of this constructive price action. Both bitcoin and eth have rallied up towards critical consolidation high resistance levels, and have yet to take them out. Bitcoin needs to get back above the June high at $41,325 to suggest we’re seeing a shift in the structure, while ether needs to break through the July high at around $2,415 to take the pressure off the downside. |

|

LMAX Digital metrics |

||||

|

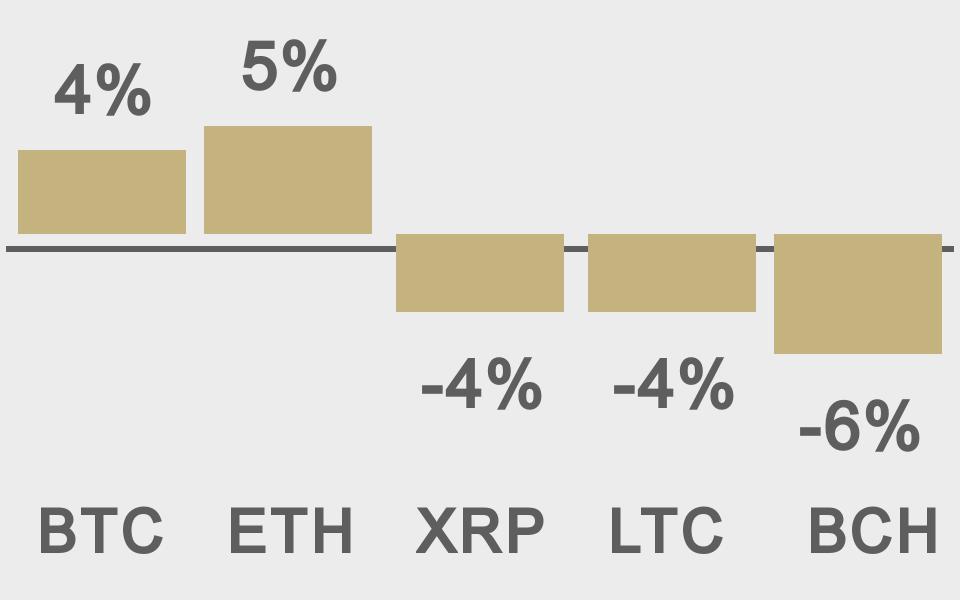

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

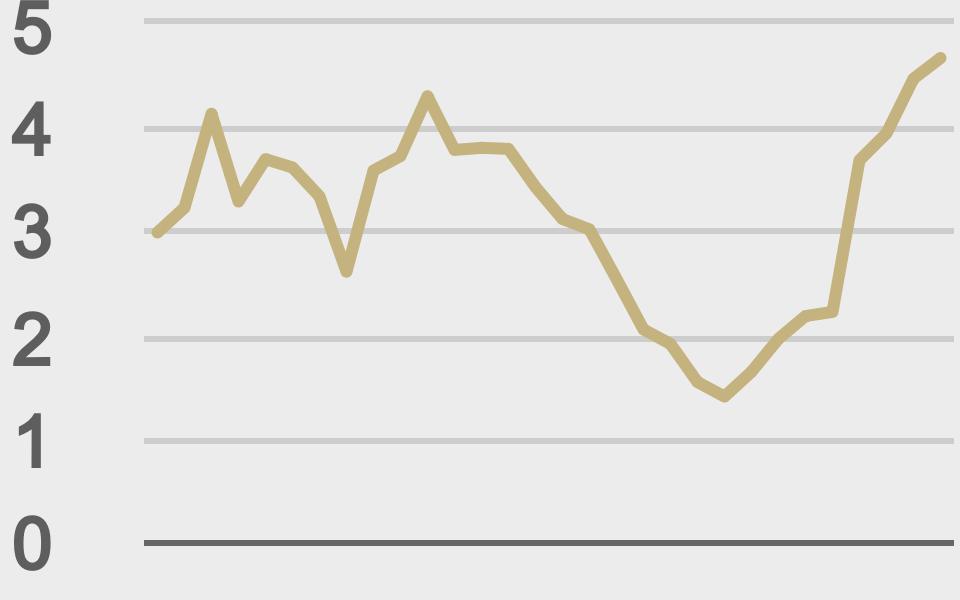

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||