|

|

25 April 2023 Nothing more than a correction right now |

| LMAX Digital performance |

|

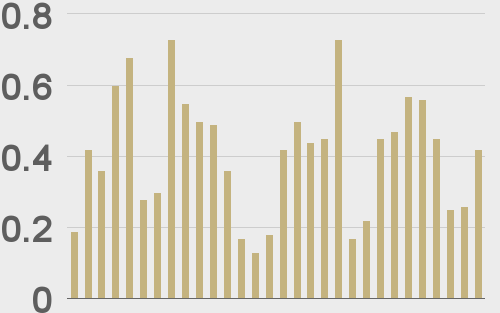

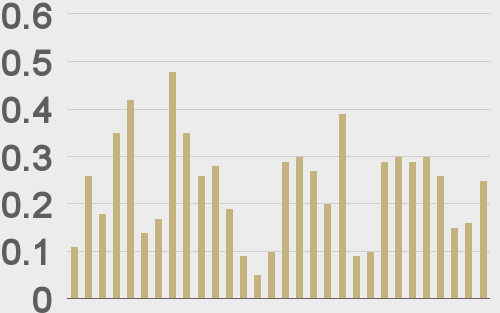

LMAX Digital volumes were up overall as the week got going. Total notional volume for Monday came in at $424 million, 3% above 30-day average volume. Bitcoin volume printed $254 million on Monday, 8% above 30-day average volume. Ether volume came in at $127 million, 15% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,727 and average position size for ether at 2,969. Volatility has been trending lower in correction mode after peaking out at a yearly high in March. We’re looking at average daily ranges in bitcoin and ether of $940 and $75 respectively. |

| Latest industry news |

|

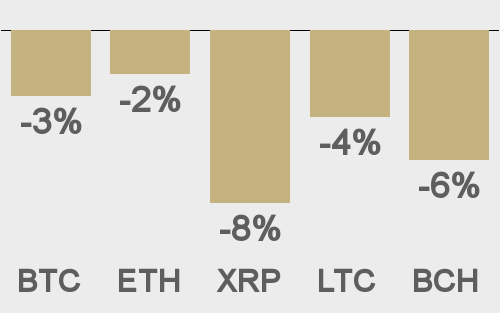

Crypto assets have been under pressure since bitcoin topped out at a fresh yearly high in the middle of the month. The primary drivers of the price action are more hawkish Fed rate hike expectations, a downturn in global risk sentiment, and concerns over the lack of clarity around crypto regulation. But if we break each one of these negative drivers down, things don’t look all that bearish and what we really have is more of an overdue correction playing out following an impressive early 2023 run. While it’s true, the market may be pricing a more aggressive Fed than what it had wanted, we are getting closer to peak rates. Moreover, higher rates could have a bullish impact on bitcoin if the market sees bitcoin as a flight to safety, store of value asset. And as far as crypto regulation goes, the market is feeling a little more unsteady in the aftermath of last week’s SEC Chair Gensler testimony. But ultimately, we believe the path forward is a bright path with most parties involved wanting to recognize the potential of crypto and all of the benefits from the innovation that it is producing. |

| LMAX Digital metrics | ||||

|

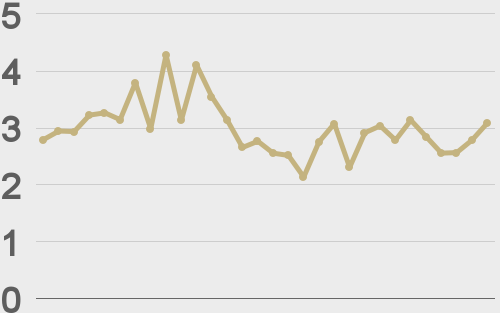

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||