|

| 19 November 2025 Nothing more than a healthy reset |

| LMAX Digital performance |

|

LMAX Digital volumes have been mostly solid in the early week as the market contends with downside pressure. Total notional volume for Tuesday came in at $665 million, 6% above 30-day average volume. Bitcoin volume printed $325 million, 6% below 30-day average volume. Ether volume came in at $220 million, 49% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $10,496 and average position size for ether at $3,095. Bitcoin and ETH volatility remains elevated just off recent multi-month highs. We’re looking at average daily ranges in bitcoin and ether of $4,114 and $227 respectively. |

| Latest industry news |

|

Recent price action in crypto—including the latest sharp downdraft—still looks more like a healthy reset than a sign of broader deterioration. Bitcoin and Ethereum have both absorbed deeper pullbacks, but importantly, those declines have carried prices back toward major technical support rather than breaking the overarching uptrend. Bitcoin’s retreat from record highs and Ethereum’s reversal after surpassing its 2021 peak appear to be part of a natural correction phase following an extraordinary multi-month run. That run—driven by accelerating institutional adoption, improving regulatory clarity, and continued maturation of market infrastructure—remains the dominant story. Even with the recent softness, the foundation for a renewed push into year-end is intact. With seasonality still constructive and the corrective phase beginning to show signs of exhaustion, we expect markets to stabilize into support and rebuild momentum as positioning resets. As macro conditions gradually turn more supportive—particularly if the Dollar’s broader downtrend resumes and risk appetite continues to improve—we anticipate volumes will re-expand meaningfully. Fresh institutional inflows and renewed retail participation should provide a strong tailwind into year-end. In that environment, crypto stands well positioned to benefit disproportionately from both risk rotation and the hunt for higher-beta, alternative assets. |

| LMAX Digital metrics | ||||

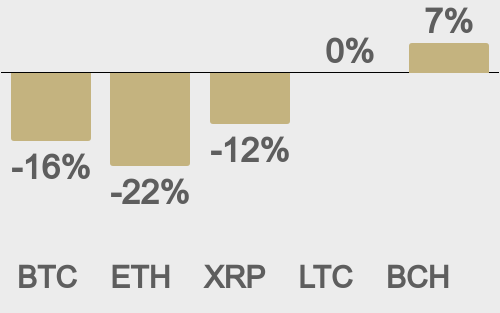

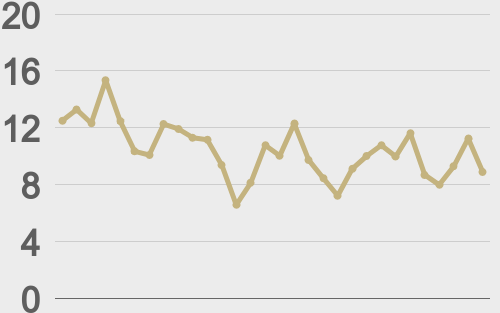

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

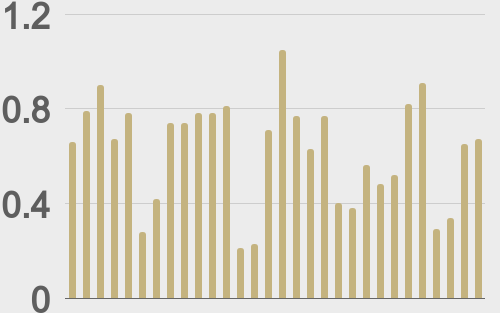

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

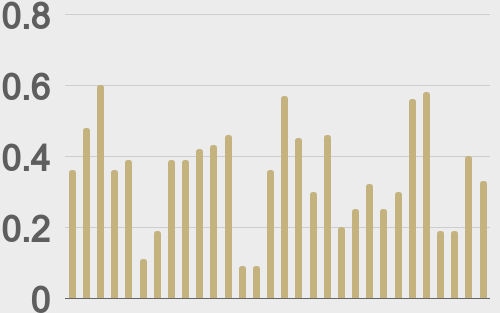

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

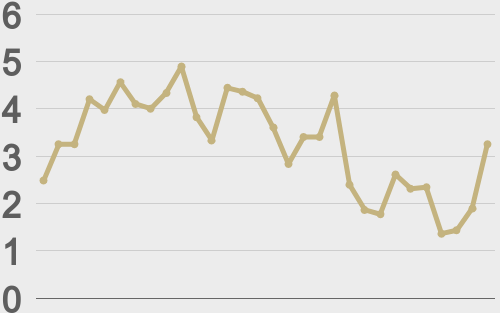

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@swissblock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||