|

|

18 December 2023 Nothing more than a minor correction |

| LMAX Digital performance |

|

Total notional volume at LMAX Digital held steady in the previous week, after a very strong performance a week earlier. Total notional volume from last Monday through Friday came in at $4.7 billion, 2% lower than a week earlier. Breaking it down per coin, bitcoin volume came in at $3.8 billion in the previous week, 2% lower than the week earlier. Ether volume came in at $644 million, 3% lower than the week earlier. Total notional volume over the past 30 days comes in at $17.6 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $14,813 and average position size for ether at $3,420. Volatility has been trending higher and is consolidating off recent yearly high levels. We’re looking at average daily ranges in bitcoin and ether of $1,484 and $89 respectively. |

| Latest industry news |

|

The crypto market has cooled off in recent sessions after another impressive run to fresh yearly highs in the price of bitcoin and ether. At this stage, the pullback is viewed as nothing more than a minor correction ahead of the next big run to the topside. Technically speaking, in today’s chart analysis, we’ve highlighted the strong uptrend in the price of bitcoin and show the market tracking well above rising trend-line support. This suggests there is room for the correction to extend some more, before we do in fact see that next run higher, with setbacks ultimately well contained into the rising trend-line support and above $38k. Fundamentally, while things have been relatively quiet, it’s possible some of the latest selling could be coming from a wave of renewed broad based US Dollar demand. There had been an intense round of Dollar selling in the aftermath of the dovish Fed decision. But since then, we’ve gotten some pushback from various Fed officials which has called the market’s dovish repricing into question. And so, with the market buying Dollars, it would make sense to see some selling in crypto assets as well on account of the readjustment in yield differentials. On a positive note, there has been increased chatter around additional demand for bitcoin coming from Qatar’s sovereign wealth fund, to the tune of $500 billion. This demonstrates the fact that there is plenty of demand for the crypto asset beyond demand coming from the narrative around the SEC approval of bitcoin spot ETF applications. |

| LMAX Digital metrics | ||||

|

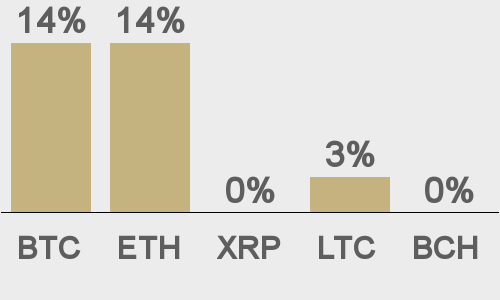

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

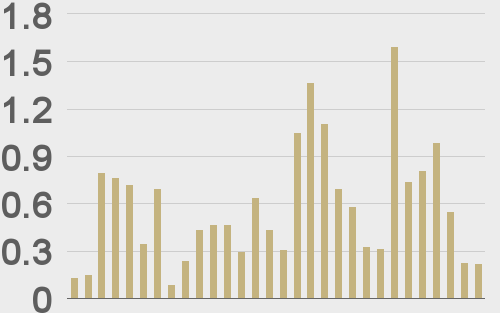

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

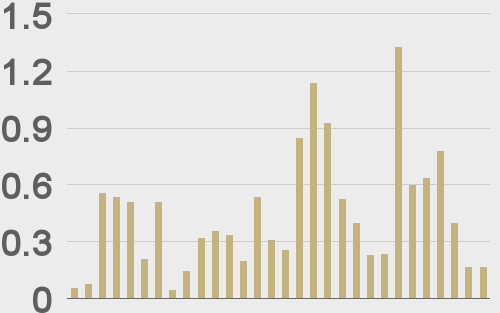

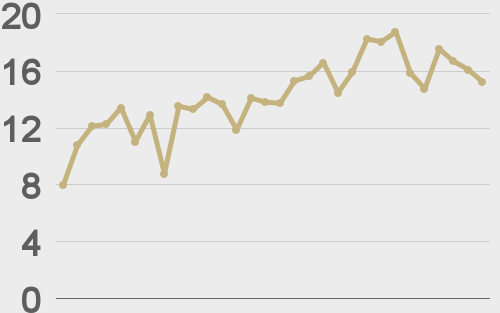

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

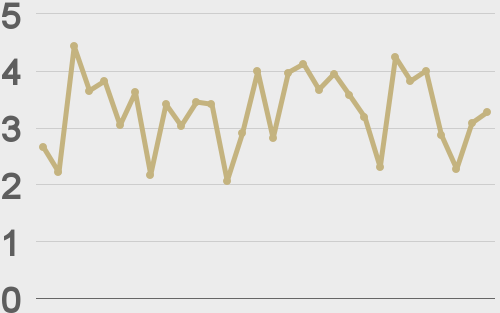

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||