|

|

3 April 2024 Nothing to worry about |

| LMAX Digital performance |

|

LMAX Digital volumes picked back up on Tuesday as markets returned to fuller form post Easter holiday. Total notional volume for Tuesday came in at $896 million, 6% above 30-day average volume. Bitcoin volume printed $492 million on Tuesday, 2% above 30-day average volume. Ether volume came in at $269 million, 17% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,955 and average position size for ether at $4,619. Market volatility has been in cool down mode since peaking in Mid-March. We’re looking at average daily ranges in bitcoin and ether of $3,375 and $204 respectively. |

| Latest industry news |

|

When looking at bitcoin and crypto assets, it’s especially important to constantly be putting things in perspective. This is a new asset class that’s still trying to find its way, and as such, there are going to be periods of volatility along the way. The perspective we’re talking about is the big picture takeaway that the trend has been uncompromisingly bullish. Bitcoin is up by a significant margin against all other major assets year-to-date (+56%). The same can be said for ETH as well (+45%). Now that we’ve established this fact, we can move on to the reality that a period of pullback was going to happen. Technically speaking, there was going to need to be a correction after the rocket ship run to bitcoin’s fresh record high in Q1. Fundamentally speaking, we have been talking about the risk for some time that a downturn in sentiment towards overcooked US equities, could be a catalyst that weighs on bitcoin and crypto assets, at least over the short-term, before a quick recovery ensues. And so, when you have the market already looking for a technical correction, and when you throw in a wave of stronger US economic data that suggests the Fed might not cut as aggressively in 2024 as the market has been pricing, you get a very good reason for some downside pressure in crypto. On a positive note, there is just too much going for bitcoin as a store of value asset that would make it attractive in risk off settings, to keep the asset down for any meaningful period of time. Indeed, volatility can be stomach turning. Having said that, we don’t expect any dips in 2024 to trade much below $50k for any meaningful period of time, if at all. Another positive note right now is seasonality. When we look at bitcoin’s historical performance, the month of April has proven to be bitcoin’s second best month of performance, producing gains of over 11% since 2014. |

| LMAX Digital metrics | ||||

|

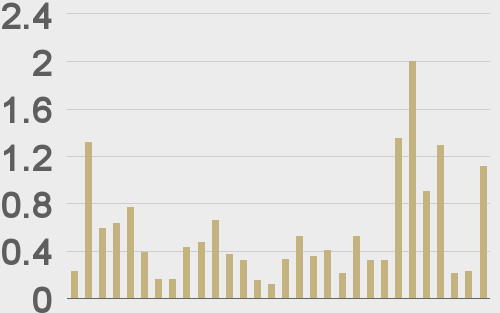

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

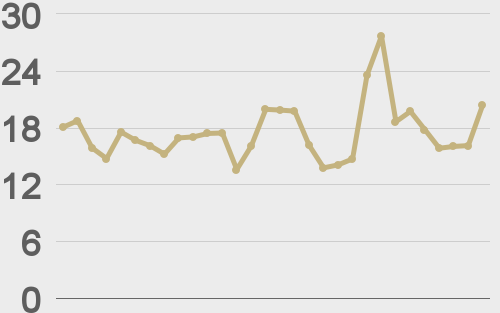

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||