|

|

| On the bright side |

| LMAX Digital performance |

|

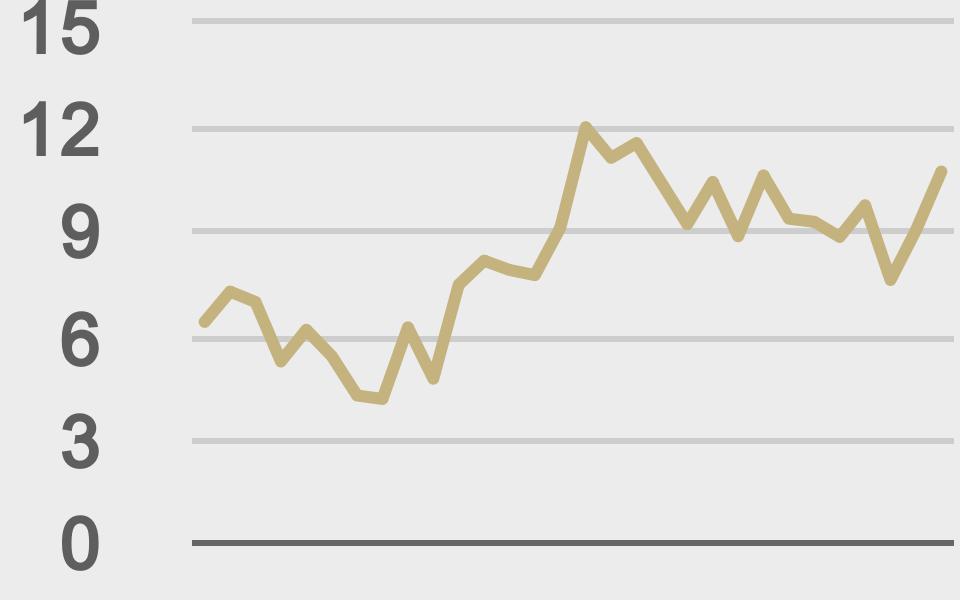

Volumes at LMAX Digital continue to trend higher in August, with total notional volume hitting its highest level for the month on Monday, coming in at $1.6 trillion, a whopping 67% above 30-day average volume. The volume gains in bitcoin and ether have been impressive, with bitcoin volume coming in just shy of a yard on Monday, at $966 million, 71% above 30-day average volume, and ether volume coming in at $382 million, 56% above 30-day average volume. Total notional volume at LMAX Digital comes in at $29 billion over the past 30 days. Average position sizes for bitcoin and ether also jumped quite a bit on Monday. Bitcoin average size for Monday was $10,708, while ether average position size for Monday was $4,367. |

| Latest industry news |

|

For the moment, the crypto market has done a really good job taking in the news of the US Senate rejecting an amendment in the infrastructure bill that would have made for a more favorable definition of players in the space who would be exempt from tax reporting requirements. It seems the community is more focused on all the positives around efforts made to work towards a coherent amendment, while dismissing the fact that the amendment simply didn’t go through because one Senator voted it down on his alternative agenda. Overall, the fact that the government is recognizing the benefits of crypto and is more willing to listen to those in the community, in an effort to help pass regulation that both makes sense and allows the industry to flourish, should be a net positive. |

|

LMAX Digital metrics |

||||

|

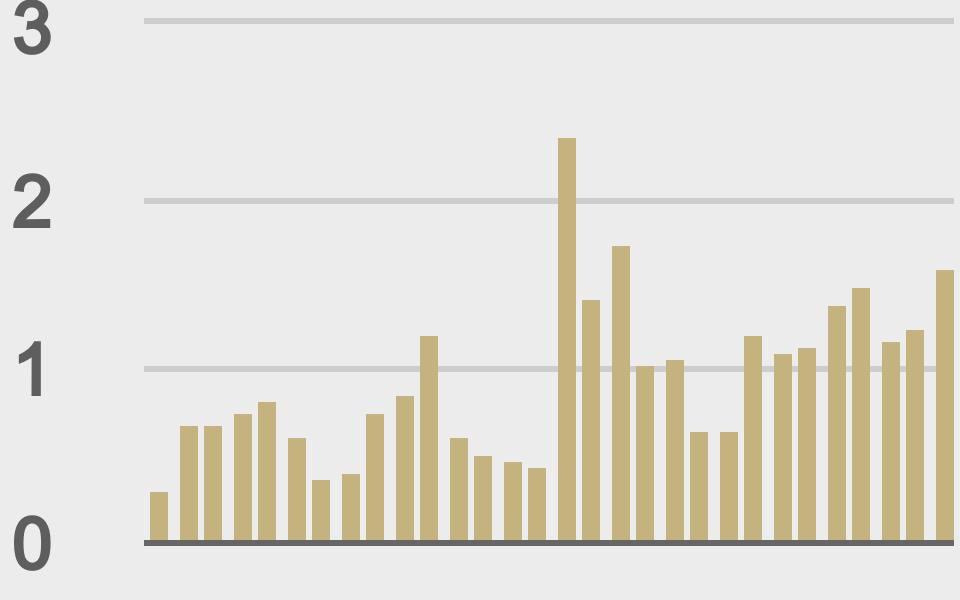

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||