|

|

7 September 2023 One big waiting game |

| LMAX Digital performance |

|

LMAX Digital volume cooled off on Wednesday. Total notional volume for Wednesday came in at $158 million, 12% below 30-day average volume. Bitcoin volume printed $91 million on Wednesday, 15% below 30-day average volume. Ether volume printed $46 million, 5% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,524 and average position size for ether at $2,452. Volatility is trying to hold up after recovering from cycle lows in August. We’re looking at average daily ranges in bitcoin and ether of $708 and $47 respectively. |

| Latest industry news |

|

We continue to see very little movement in the crypto market, with trading ranges quite limited. At the moment, it feels like the next big move will come when we finally get an SEC approval of a bitcoin ETF application. Interestingly enough, the market has grown so cautious, that it no longer is even interested in rallying on upbeat and optimistic comments around the approval of a bitcoin ETF. The other day, former SEC Chair Jay Clayton was out saying he believed the approval of a bitcoin spot ETF was inevitable despite the delay of seven applications. The trouble is that Jay Clayton is the former SEC Chair and the current SEC Chair has been a lot more contentious with respect to helping to push things forward for bitcoin and crypto overall. We’ve also highlighted another challenge for crypto assets right now, which is seasonality. Market participants are less inclined to be wanting to buy crypto in a month where bitcoin has only produced two positive September performances over the past decade. However, despite the hold up on the buy side, there is plenty of longer-term interest into support, with these players recognizing the value proposition in accumulating crypto assets at perceived discounted prices. Look no further than a bitcoin price that has been exceptionally resilient on dips into the $25k area. |

| LMAX Digital metrics | ||||

|

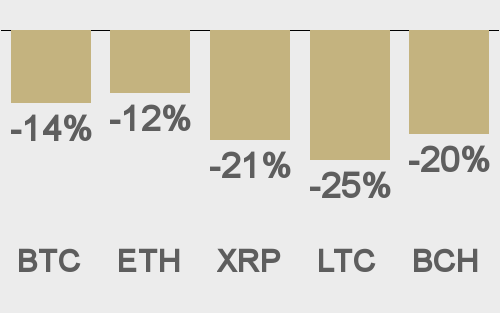

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||