|

|

3 February 2022 One more drop before the next big pop |

| LMAX Digital performance |

|

LMAX Digital volume has held steady this week after picking up following the slow Monday start. Total notional volume for Wednesday came in at $765 million, just 1% below 30-day average volume. Bitcoin volume printed $427 million on Wednesday, 8% above 30-day average volume. Ether volume came in at $273 million, right on point with 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,644 and average position size for ether at 5,354. Volatility has been trending lower into 2022. We’re now looking at average daily ranges in bitcoin and ether of $2,007 and $205 respectively. |

| Latest industry news |

|

We’re still talking macro risk and impact on crypto, and we still believe this could play a major influence on the direction of bitcoin and ether over the coming days. At the moment, this latest rally looks to be fizzling out and this sets the stage for another drop to fresh yearly lows. Fundamentally, the core focus continues to be around investor risk appetite and sentiment towards US equities. We saw an attempt to continue to extend the rally in stocks on Wednesday after US data came in soft – this on the expectation it would allow the Fed to ease up. But the rally lost momentum and we think a lot of this has to do with the fact that bad data and an easier Fed no longer works when inflation is a factor. And so, we still see risk for more downside pressure in US equities, which will translate to more downside pressure on crypto assets. Technically speaking, things align well with this fundamental outlook. As per our chart analysis today, bitcoin has stalled out into critical falling trend-line resistance from the pullback off the record high from November 2021. This sets up the next major downside extension to retest the critical low from June 2021 at $28,800. Once, and if we get down there, we think the picture will change and the outlook will become a lot brighter. Once, and if we get down there, we believe there will be plenty of heavy interest from medium and longer-term players who recognize the highly compelling value proposition of crypto. |

| LMAX Digital metrics | ||||

|

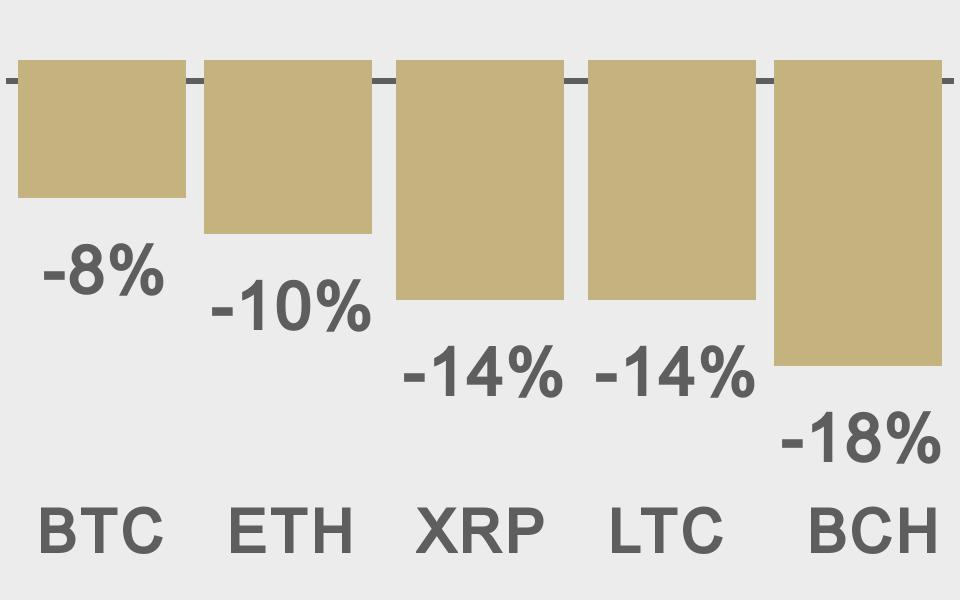

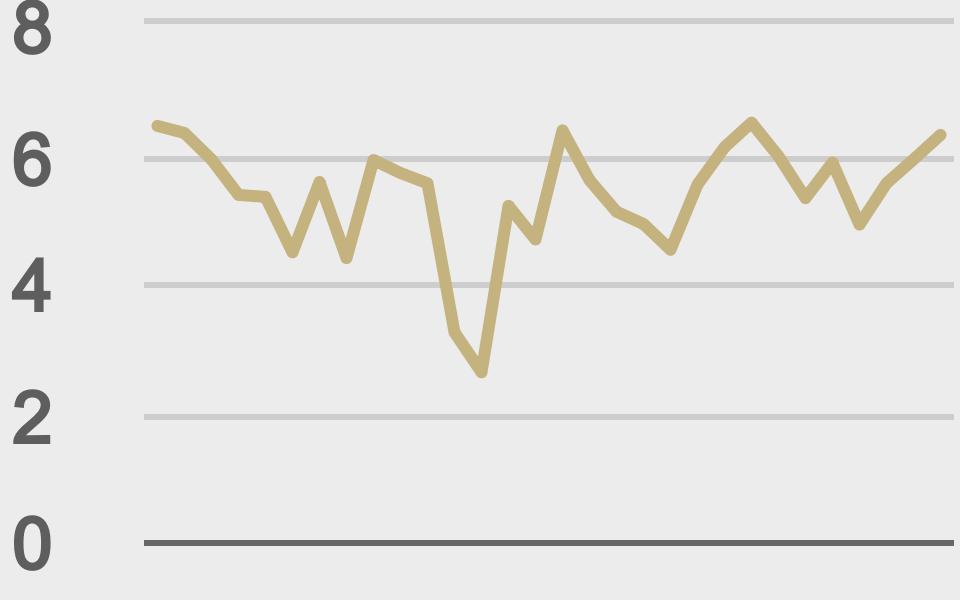

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

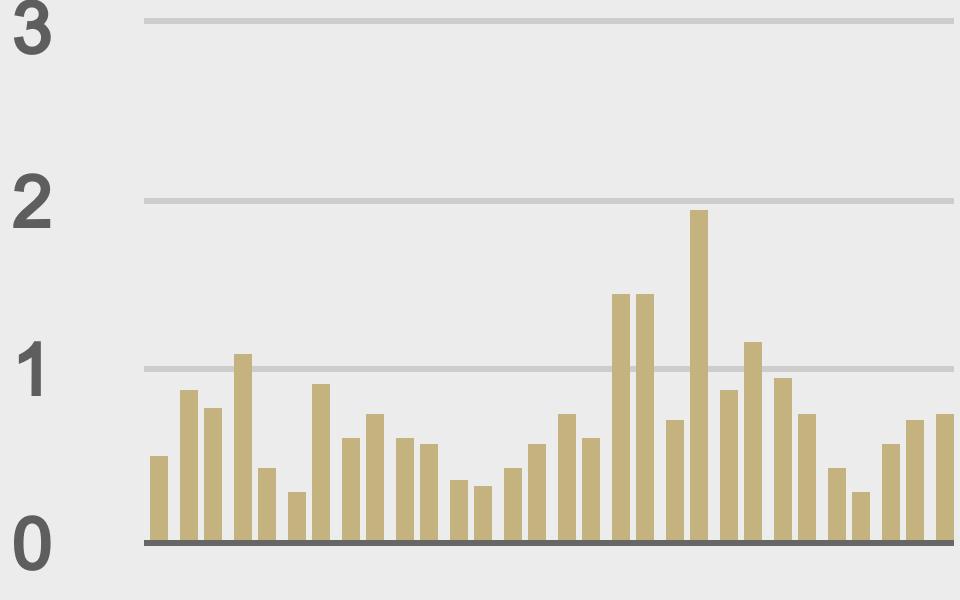

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

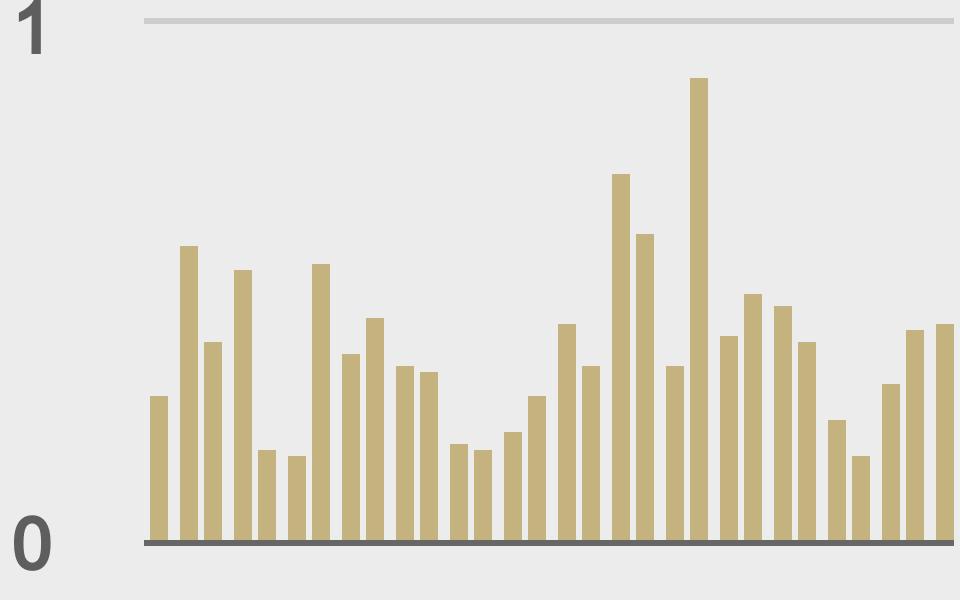

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

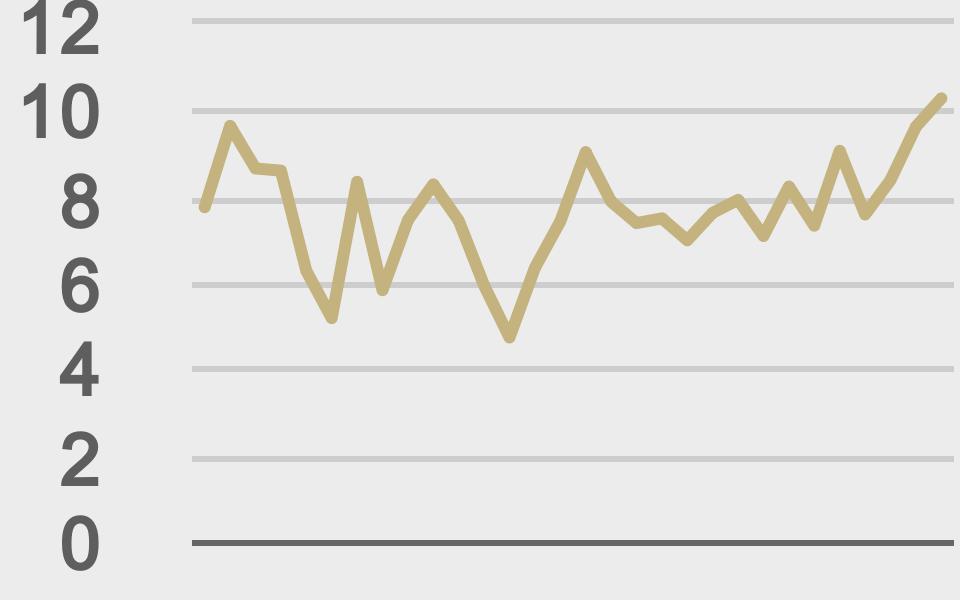

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@decryptmedia |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||