|

|

26 June 2023 Outlook improves as bitcoin pushes back above $30k |

| LMAX Digital performance |

|

Total notional volume at LMAX Digital was up yet again in the previous week. Total notional volume from last Monday through Friday came in at $2.5 billion, 18% higher than the week earlier. Breaking it down per coin, Bitcoin volume came in at $1.54 billion in the previous week, 26% higher than the week earlier. Ether volume came in at $669 million, 11% higher than the week earlier. Total notional volume over the past 30 days comes in at $10.46 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $6,695 and average position size for ether at $2,761. Volatility has returned to the market in the month of June after trading down near yearly low levels to start the month. We’re looking at average daily ranges in bitcoin and ether of $1,023 and $65 respectively. |

| Latest industry news |

|

We’re coming out of an impressive week of performance in the crypto space. Bitcoin leading the charge is usually a good sign the market is focused in all the right places. This fact accompanied by an impressive rally through $30k to a fresh yearly high, and higher volumes along the way, is most encouraging. A lot of the latest drive higher can be attributed to notable names in the traditional financial markets space making moves to take on meaningful exposure to crypto. BlackRock and Citadel are two of the biggest names mentioned in last week’s headlines around moves in the space. And in the aftermath of a scare from the SEC a few weeks back, all is looking exceptionally well, as the interest from these larger players projects a confidence in the outlook. Another encouraging sign from the price action front is that crypto has held up well in the face of this latest slide in US equities. There has been sensitivity to downturns in stocks in the past, and seeing crypto rallying while stocks are under pressure, shows there is more to the asset class as an attractive uncorrelated play. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

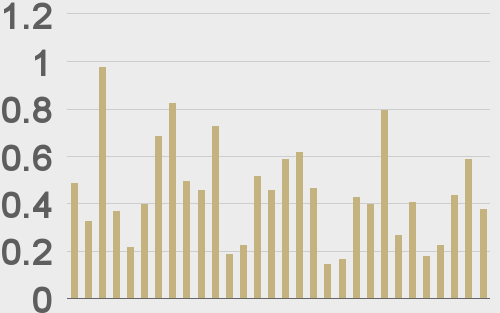

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

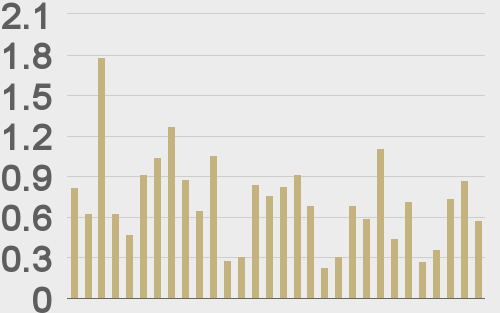

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||