|

| 26 June 2025 Positioning for a robust H2 2025 |

| LMAX Digital performance |

|

LMAX Digital volumes remained healthy overall on Wednesday. Total notional volume for Wednesday came in at $521 million, 15% above 30-day average volume. Bitcoin volume printed $293 million, 38% above 30-day average volume. Ether volume came in at $73 million, 36% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,074 and average position size for ether at $2,905. Bitcoin volatility is slowly turning up from yearly low levels, while ETH volatility has been contained since bottoming in May. We’re looking at average daily ranges in bitcoin and ether of $3,012 and $143 respectively. |

| Latest industry news |

|

Bitcoin’s ongoing support has been fueled by robust U.S. spot ETF inflows, driven by strong institutional demand. Meanwhile, reduced exchange holdings in ETH suggest long-term bullish sentiment as investors settle into conviction plays. Traditional markets have contributed to crypto dynamics as well, with a softer U.S. dollar—spurred by speculation over President Trump’s early Fed Chair replacement considerations—enhancing bitcoin’s appeal as an inflation hedge. Global politics have provided yet another supportive backdrop, with the reported Israel-Iran ceasefire easing tensions, fostering a risk-on environment that has also overall support to the crypto market. Upcoming U.S. economic data, including advance trade, Q1 GDP, and durable goods, could influence Federal Reserve rate decisions and should be watched closely. The market will also be monitoring risks of renewed trade tensions or U.S. tariff threats. Overall, the outlook remains highly constructive for crypto assets. As a reminder, we’re coming to the end of a June month that has historically been a flat month for bitcoin performance. The good news is that we’re also heading into a second half of the year that has been exceptionally rewarding for the crypto market. From a technical perspective, all of this adds up. Bitcoin is in a bullish consolidation just below the record high, positioned to look to make that next big push towards $150k. ETH is in its own bullish consolidation and will be looking for that next big breakout beyond $2,900. |

| LMAX Digital metrics | ||||

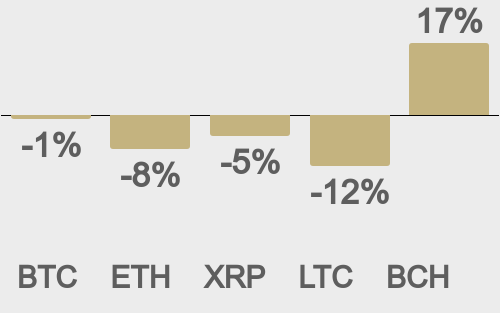

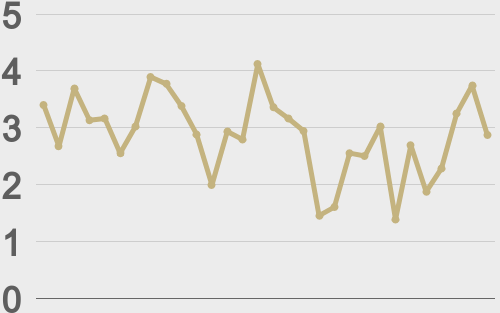

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

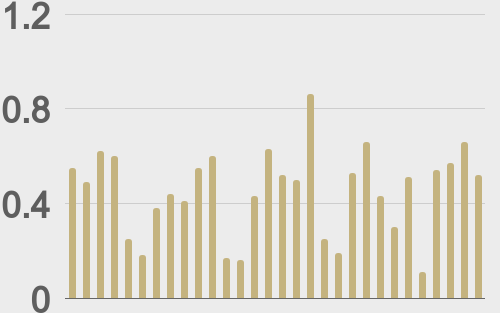

| Total volumes last 30 days ($bn) |

||||

|

||||

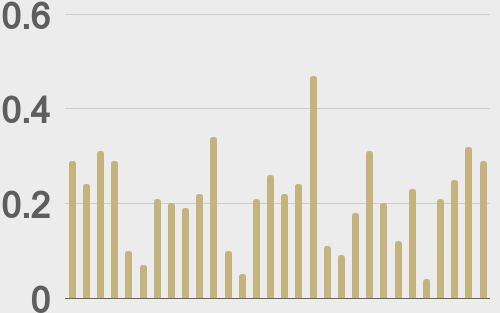

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||