|

|

20 September 2023 Positive catalysts and key event risk |

| LMAX Digital performance |

|

LMAX Digital total notional volume for Tuesday came in at $266 million, 35% above 30-day average volume. Bitcoin volume printed $203 million on Tuesday, 61% above 30-day average volume. Ether volume came in at $43 million, 16% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,572 and average position size for ether at $2,302. Volatility has picked up ever so slightly after recovering from cycle lows in August. We’re looking at average daily ranges in bitcoin and ether of $688 and $42 respectively. |

| Latest industry news |

|

Price action has been constructive and volumes have been on the rise, both positive developments for the crypto market. At the same time, as per our technical insights, we will need to see bitcoin back above $28,200 to inspire fresh bullish momentum. As far as recent bullish catalysts go, chatter has been making the rounds about BlackRock acquiring 12,200 bitcoin – if true – clearly reflecting a strong vote of confidence in bitcoin. We’ve also heard good news from other institutional participants in the traditional financial markets space. Nomura’s digital assets subsidiary Laser Digital has unveiled its Bitcoin Adoption Fund designed to target institutional investors. Meanwhile, Citigroup has been making moves of its own in the digital asset space. Citi has entered into a custodial partnership with Bondblox Bond Exchange, and is also piloting a program to transform customer deposits into digital tokens in an effort to meet client demands. Another encouraging update this week comes from bitcoin metrics. The percentage of supply held by long-term holders has pushed back up into record high territory, while bitcoin dominance has also pushed to its highest level in a month and near a 26-month high. Looking ahead, a lot of today’s focus will shift to the Fed decision. Lately, there has been a disconnect in correlations with market reaction to monetary policy announcements. But it will be important to see if there are any strong Dollar moves in the aftermath. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

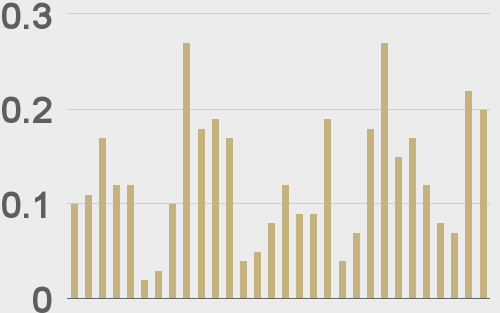

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||