|

|

16 October 2024 Positive catalysts keep coming |

| LMAX Digital performance |

|

LMAX Digital volumes were impressive on Tuesday. Total notional volume for Tuesday came in at $433 million, 46% above 30-day average volume. Bitcoin volume printed $275 million on Tuesday, 50% above 30-day average volume. Ether volume came in at $75 million, 11% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,163 and average position size for ether at $3,067. Market volatility is showing signs of wanting to bottom out after trending lower since August. We’re looking at average daily ranges in bitcoin and ether of $2,107 and $103 respectively. |

| Latest industry news |

|

Overall, activity in the crypto market is looking quite healthy in October, consistent with bullish seasonal trend studies. Interestingly enough, most of the impressive performance in October has come in the latter half of the month, offering up additional encouragement about the outlook from now through the end of October. As far as the positive drivers go, we would cite US election poll updates, MicroStrategy news, and an endorsement from JP Morgan as some of the bigger catalysts at the moment. Donald Trump has been gaining in the polls, with predictive markets now showing him out in front and favored to win the election. Donald Trump has been decidedly more crypto friendly and this news has fueled additional demand for crypto assets. Meanwhile, Michael Saylor continues to outline ambitious plans for the company, revealing the ultimate objective for MicroStrategy to be a bitcoin investment bank with $150 billion in bitcoin holdings. US banking giant JP Morgan has further contributed to bitcoin’s bid after saying current macro headwinds are likely to reinforce the debasement trade, with bitcoin and gold to benefit. The cherry on top of this latest wave of demand for crypto assets has come from bitcoin and ETH spot ETF flows which have been extremely impressive in recent days. Technically speaking, the next big level of resistance comes in the form of the July high at $70,000 which guards against the March record high. |

| LMAX Digital metrics | ||||

|

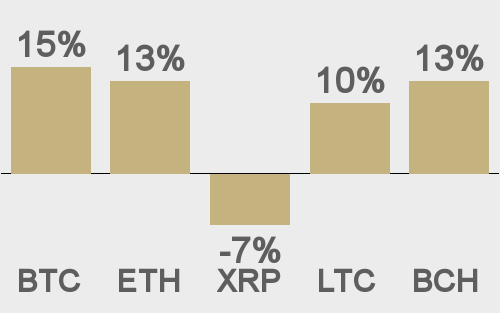

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

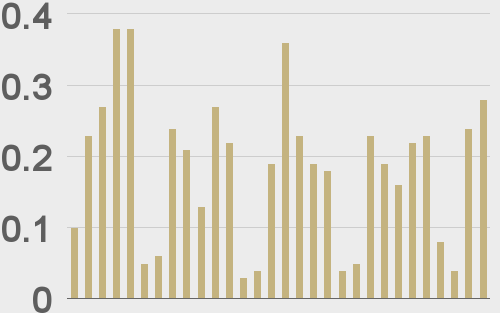

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

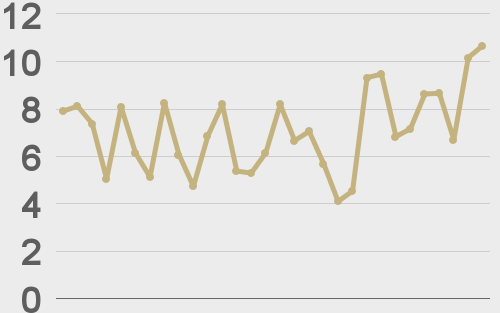

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

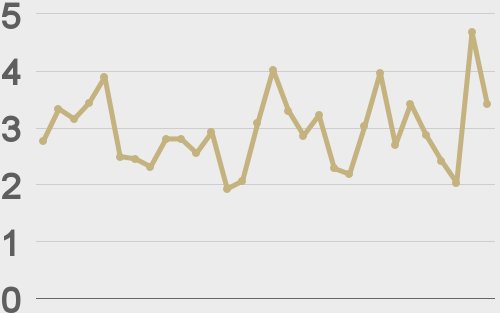

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||