|

|

14 December 2023 Post Fed decision crypto pop |

| LMAX Digital performance |

|

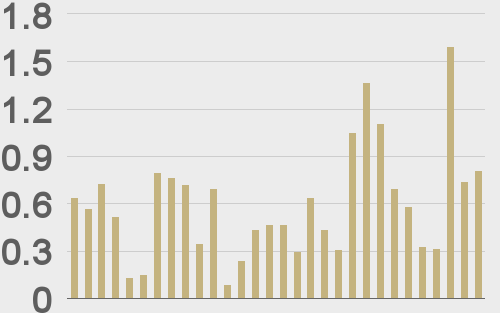

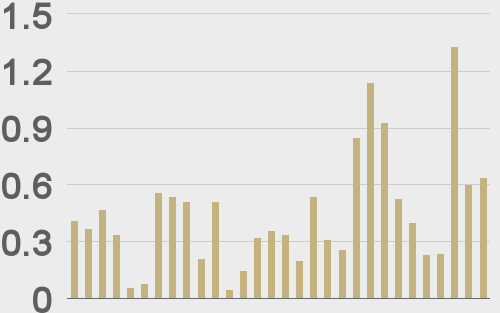

LMAX Digital volumes have been very strong all week. Monday volume was the highest since November 2022 and this was followed up with solid showings on Tuesday and Wednesday. Total notional volume for Wednesday came in at $810 million, 34% above 30-day average volume. Bitcoin volume printed $639 million on Wednesday, 42% above 30-day average volume. Ether volume came in at $125 million, 13% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $14,120 and average position size for ether at $3,499. Volatility is trending higher overall in recent months, with bitcoin and ether volatility extending to fresh yearly highs. We’re looking at average daily ranges in bitcoin and ether of $1,473 and $90 respectively. |

| Latest industry news |

|

Earlier this week, in our Monday note, we cited three reasons for the pullback in crypto prices – all three of which being short-term drivers that were not expected to have any meaningful impact on overall bullish price action. And as we move into the heart of the latter portion of the week, crypto assets are once again back to showing an impressive bid tone. We’ve already talked about how trends have a way of pushing into year end, which means we wouldn’t at all be surprised to see fresh yearly highs in bitcoin and ether over the coming days. The macro picture certainly won’t hurt this cause either. On Wednesday, the Fed came out and downgraded its guidance on growth, inflation and rates. The dovish decision sent the US Dollar much lower, which has also translated to crypto inflows. We’ve also recently heard from the CEO of Wall Street broker Cantor Fitzgerald who has said he is a fan of crypto, with a specific reference to bitcoin. This has generated additional bids as it sends a message traditional participants are gearing up for adoption. Finally, in another crypto supportive development, BlackRock has amended its bitcoin ETF application, tweaking the language so that it can better cater to major banks. BlackRock has introduced a cash-based participation method so these banks won’t need to hold cryptocurrency to invest, thereby circumventing pre-existing regulatory constraints. |

| LMAX Digital metrics | ||||

|

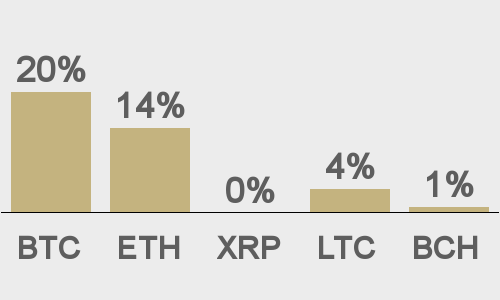

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

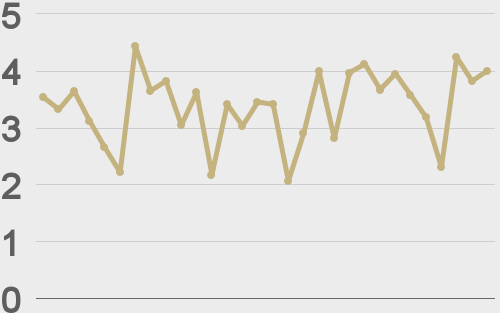

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@balajis |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||