|

|

1 May 2023 Previous week sees big bump in volume |

| LMAX Digital performance |

|

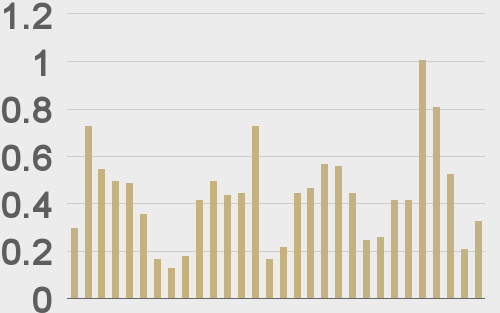

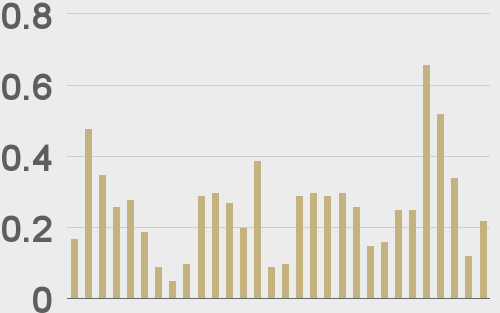

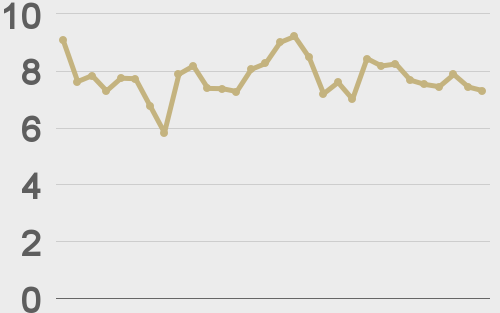

Total notional volume at LMAX Digital trended up in the previous week. Total notional volume from last Monday through Friday came in at $3.2 billion, 28% higher than the week earlier. Breaking it down per coin, Bitcoin volume came in at $2 billion in the previous week, 41% higher than the week earlier. Ether volume came in at $854 million, 17% higher than the week earlier. Total notional volume over the past 30 days comes in at $13.1 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,723 and average position size for ether at $2,968. Volatility has come back down after recently trading up to yearly high levels. We’re looking at average daily ranges in bitcoin and ether of $1,065 and $78 respectively. |

| Latest industry news |

|

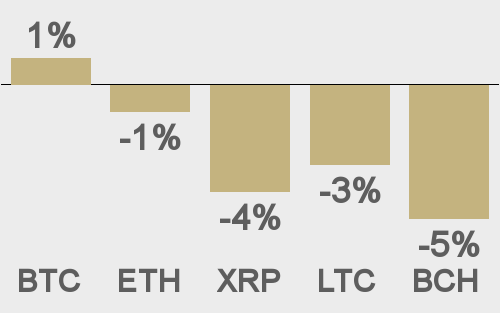

Crypto markets have come under pressure as the new week and new month gets going. There hasn’t been a whole lot in the way of headlines to make sense of the price action, though we suspect, Friday’s US core PCE reads could be behind some of the selling. If the market is concerned about ongoing sticky inflation in the US, this will translate to expectations of a higher for longer Fed rate hike path, which in turn, will result in more favorable US Dollar yield differentials, thereby weighing on crypto. Other concerns in the space revolve around regulatory uncertainty in the US, a situation that has been a little more tense in recent days on account of confusing testimony from the SEC Chair, and subsequent moves at major exchanges Coinbase and Kraken. Both exchanges have taken issue with the US regulatory process and both are reluctant to cooperate with a process that has been so unfriendly to participants who have been doing everything they can to work within a US regulatory framework, only to be punished for it. But overall, we remain optimistic that regulatory headwinds will sort themselves out and we will continue to see major adoption in crypto assets for the remainder of 2023 and beyond. The story of an alternative diversification option where assets can be self-custodied has become increasingly compelling and should continue to drive inflows into the crypto space. As far as monthly performance goes, it’s worth noting that we did see another positive month of performance in the month of April. Gains were mild, but both bitcoin and ether closed out the month up about 2.7%. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

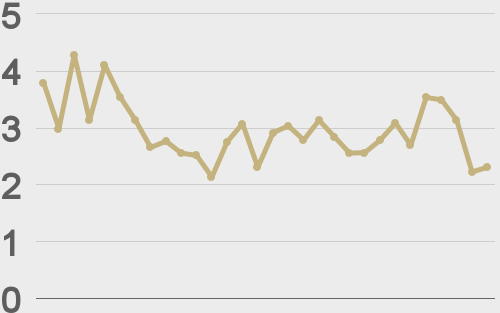

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CNBC |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||